Business

Forex crisis: BDCs ask CBN for autonomy to go digital

The Association of Bureau De Change Operators of Nigeria (ABCON) has called on the Central Bank of Nigeria (CBN) to give autonomy to BDCs autonomy to go digital.

This is in line with the CBN’s tech reforms for BDCs for rate convergence and ABCON’s various digitization reforms for Bureau de Change operators from 2016 to date.

This disclosure is contained in a statement issued by ABCON and seen by Nairametrics, where it noted that the exchange rate volatility has continued to give rise to the slow economic growth of Nigeria recently.

ABCON called on the CBN to diversify the scope of operation and business model of the BDC operators from a base to less cash and digital platforms.

ABCON in the statement said,

- ‘’There is no doubt that exchange rate volatility has continued to underpin the slow economic growth of Nigeria in the past years.

- As a proactive Organisation and an umbrella body of central bank licensed BDCs and In Line with the recent CBN plan reforms on BDCs to be tech savvy and Abcon’s BDCs’ various digitization reforms since 2016 to date, we urge the CBN to democratise and centralise the BDCs operational mechanism by allowing BDCs the autonomy to go digital.

- ‘’Given the above we called on the CBN to diversify our scope of operation and business model from cash base to less cash and digital platforms.

- ‘’ABCON in the launch of its vision for BDCs digitization through their exchange rate platform (nsijabdcs.com)unveiling in 2018 have long prepared their members to embrace technology.

- ‘’It is also important to note that Abcon has spent several million in IT research and developments, designs, and implementations of various layers of automation of the business transformation process from manual to digital.

- ‘’Our members have through automation now have transactions monitoring systems with installed IT office equipment and internet in their location.

- ‘’Our members now record their transactions on AWS I cloud in real-time online and extract their daily reports for return rendition all line real-time interface with the CBN.

- Our members have also sometimes in 2019 integrated with NIBSS client’s BVN verification and validation platform in carrying out their transactions with their members.’’

Collaboration with NFIU

It added,

- ‘’The BDCs through the collaborations of Abcon and NFIU registered on the GoAML platforms and Nil-returns platform for the rendition of their suspicious and cash transactions threshold to the NFIU in compliance with their AML/CFT obligations.

- ‘’We also have to ensure that each of us executes compliance undertaking and appointment of a Compliance officer. ABCON also constantly trains. retrains, sensitizes its members with regulators and security agencies as resource persons.

- ABCON as a custodian of regulation and self-regulatory organization believed that the BDCs posed the most effective, transparent pass-through effect and transmission mechanism of the apex bank foreign exchange policies. We achieved convergence in 2006, 2009 and 2018 to 2020 before the outbreak of COVID-19 in 2020.

- ‘’It is in light of the above that we are calling on the apex bank to grant a no objection approval on our various correspondences to the apex bank to grant the sub-sector the autonomy to embrace digital payment to the sub-sector to achieve rate convergence.’’

Benefits of the autonomy

ABCON listed the benefits of granting the autonomy to include, ‘’First it will lead to a true market rate discovery.

- ‘’Secondly, it will enhance the achievement of the federal Government’s harmonized foreign exchange rate policies.

- ‘’Thirdly, will make the BDC transactions monitoring system effective and conforming with their compliance obligation to statutory and regulatory requirements.

- ‘’Fourthly, it will harmonize and centralize the market and thus make the BDCs the moderating and correcting mechanism for the market. In the same vein, it will create additional employment for the over 40,000 employees direct and indirect in the BDC sub-sector.

- ‘’Finally, it will usher in Transparency, accountability and ease of supervision.’’

Business

JUST IN: CBN reduces banks’ LDR to 50%

The Central Bank of Nigeria has announced a review of the loan-to-deposit ratio (LDR) for banks, from 65 percent to 50 percent to align with the current monetary tightening.

LDR is used to assess a bank’s liquidity by comparing its total loans to its total deposits.

An increase in the loan-to-deposit ratio allows banks to expand their credits to businesses and individuals, however, a decline in LDR reduces their ability to loan customers from depositors’ funds.

The CBN disclosed the increase in a circular on Wednesday titled ‘Re: Regulatory Measures to Improve Lending to the Sector of the Nigerian Economy’, signed by Adetona Adedeji, its acting director of the banking supervision department.

“Following a shift in the Bank’s policy stance towards a more contractionary approach, it is imperative to review the loan-to-deposit ratio (LDR) policy to align with the current monetary tightening by the CBN,” the apex bank said.

“Accordingly, the CBN has decided to reduce the LDR by 15 percentage points to 50%, in a similar proportion to the increase in the CRR rate for banks.

“All DMBs are required to maintain this level and are further advised that average daily figures shall continue to be applied to assess compliance.

“While DMBs are encouraged to maintain strong risk management practices regarding their lending operations, the CBN shall continue to monitor compliance, review market developments, and make alterations in the LDR as it deems appropriate.”

Business

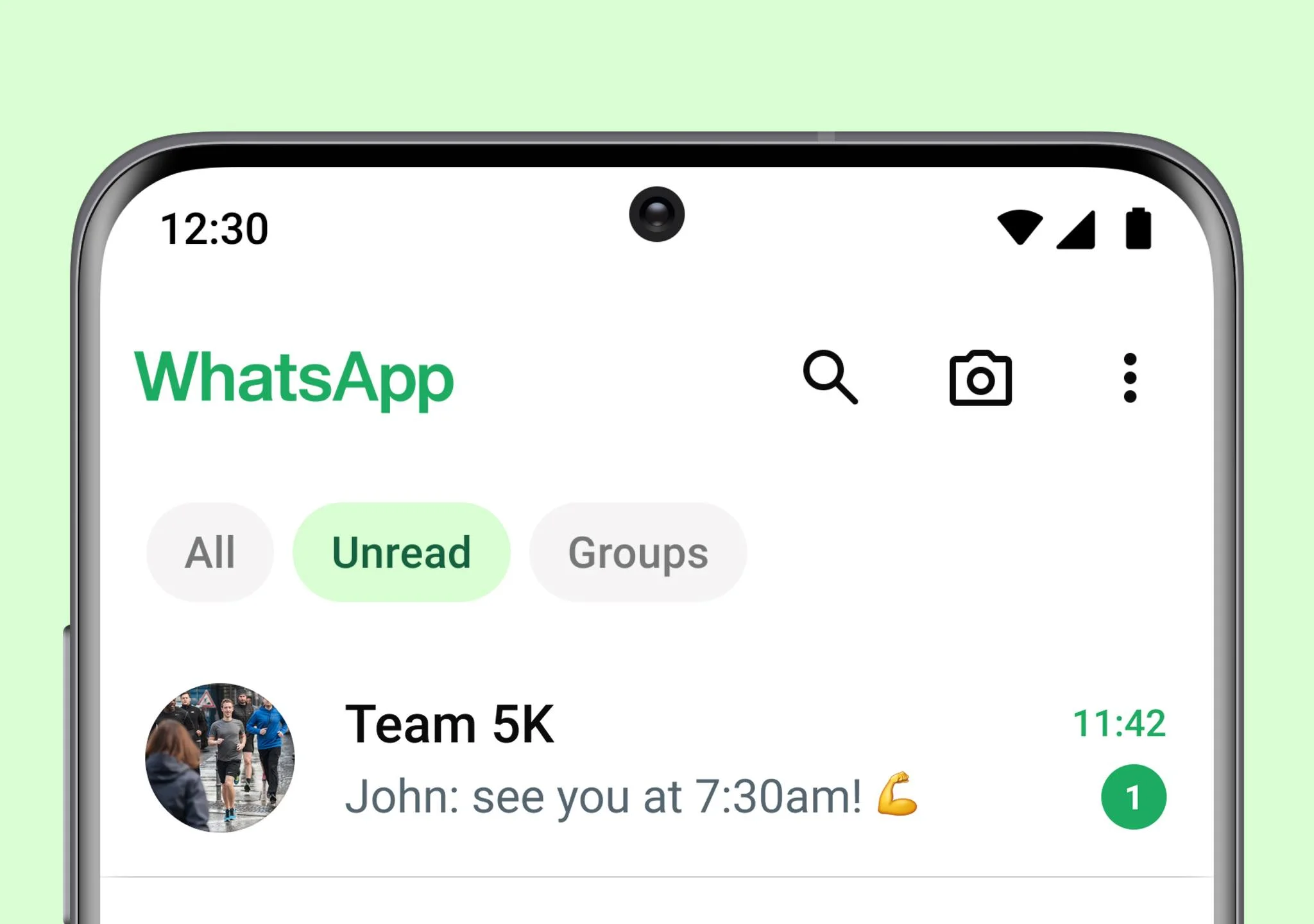

WhatsApp launches chat filters to allow users find messages faster

WhatsApp, the messaging app, has introduced chat filters to allow users to navigate through messages faster and more efficiently.

The Meta-owned platform announced the new feature in a blog post on Tuesday.

WhatsApp said it launched the new feature so that users can get to their important messages without having to scroll through their full inbox.

The social media service said the chat filters have three different features: “All, Unread, and Groups”.

It added that users can choose between any of the three filters that will appear at the top of their chat list.

“Opening WhatsApp and finding the right conversation should feel quick, seamless, and simple,” the post reads.

“As people increasingly do more on WhatsApp, it’s more important than ever before to be able to get to your messages fast.

“We believe filters will make it easier for people to stay organized and find their most important conversations and help navigate through messages more efficiently.

“We will continue to build more options to help you focus on what matters most.”

In recent times, WhatsApp has been actively rolling out new features to enhance user experiences and keep up with evolving communication trends.

In July last year, the Meta-owned firm unveiled an instant video messaging feature.

On August 8, the social network introduced a screen-sharing feature to enhance the video calling experience on its platform.

WhatsApp also introduced a feature that allows users to operate multiple accounts on a single device.

Business

NCAA suspends three private jet operators for engaging in commercial flights

The Nigerian Civil Aviation Authority (NCAA) says it has suspended the permit of three private jet operators for engaging in commercial flights.

Chris Najomo, acting director general of the NCAA, announced the suspension of the three private operators in a statement read to all airlines on Tuesday.

This is coming a day after Festus Keyamo, minister of aviation and aerospace, said the federal government would arrest and sanction illegal flights and non-certified personnel.

Najomo said the use of private jets for commercial purposes got Keyamo’s attention in November 2023, prompting the minister to issue directives for the cessation of such activities.

“Subsequently, in March 2024, the NCAA had issued a stern warning to holders of the permit for noncommercial flight (PNCF) against engaging the carriage of passengers, cargo or meal for hire reward,” Najomo said.

“The authority had also deployed its official to monitor activities of private jet terminals across airports in Nigeria. As a consequence of this heightened surveillance, no fewer than three private operators have been found to be in violation of the annexure provision of the PNCF and part 9114 of the NCAA regulations.

“In line with our zero tolerance for violation of regulations, the authority has suspended the PNCF of these operators.

“To further sanitise the general aviation sector, I have directed that a reevaluation of all orders of PNCF be carried out on or before the 19th of April 2024 to ascertain compliance with regulatory requirements.”

Najomo also said all PNCF holders will be required to submit relevant documents to the authority within the next 72 hours.

“This riot act is also directed at existing air operators certificate (AOC) holders who utilise aircraft listed on the PNCF for commercial chatter operations,” Najomo said.

“It must be emphasised that only aircraft listed in the operation specifications of the AOC are authorised to be used in the provision of such charter services.

“Any of those AOC holders who wish to use the aircraft for charter operations must apply to the NCAA to delist it from their PNCF and include it into the AOC operations specifications.”

The NCAA also urged travellers not to patronise any airline or charter operator who does not hold a valid AOC issued by the NCAA when they wish to procure chartered operation services.

Najomo also encouraged legitimate players in the aviation industry to report the activities of such “unscrupulous” elements to the authorities promptly for necessary action.

-

Entertainment1 week ago

Entertainment1 week agoBeyonce’s country album tops Billboard chart

-

Education5 days ago

Education5 days agoPrinting of JAMB slip: Beware of fake sites, police warn 2024 UTME candidates

-

News1 week ago

News1 week agoJnr Pope: NIWA rescues 7, recovers two corpses, 3 still missing in Anambra boat mishap

-

Entertainment2 days ago

Entertainment2 days agoJUST IN: Cubana Chief Priest pleads not guilty to naira abuse charge

-

Business2 days ago

Business2 days agoX will start charging new users to post, says Elon Musk

-

Entertainment6 days ago

Entertainment6 days agoAdanma Luke surrenders to police after boat mishap

-

Education1 week ago

Education1 week agoUNICAL sacks HOD over failure to present students for convocation

-

Business1 week ago

Business1 week agoNaira appreciates against dollar at official window, parallel market