Business

Benin Royal Hotel Swimming Pool Is On The 6th Floor Bouraima Dine, The President Blushes With Pride

This interview is a must read by lovers of tourism, art and culture as the hotel President is a well mannered speaker with Exceptional humility. So much to learn from this interview ad it is an amazing and educative one because the president seems to have answers to all questions. He answered with so much confidence and so proud of their services which i think should always be so when it comes to hotel or any other business

Benin Royal Hotel, Cotonou, is a darling to tourists any day, not because of its dazzling facilities, but the hotel is the first hospitality house in the country with a suspended swimming pool, located at the sixth floor.

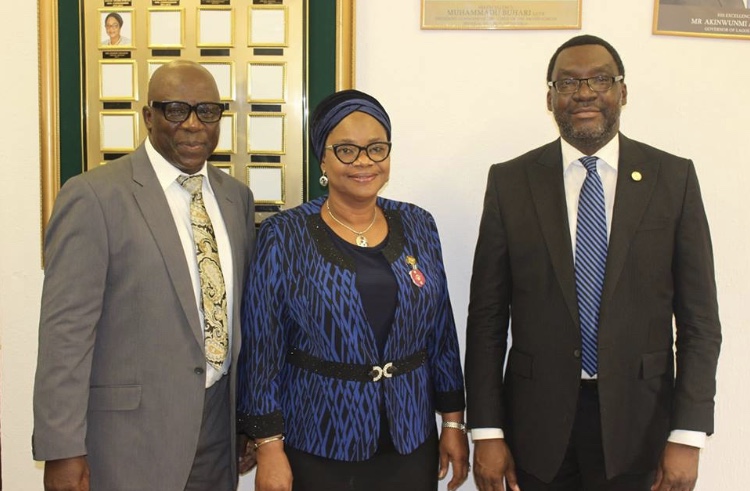

Wale Ojo Lanre who was in the hotel had a chat with Mr Bouraima Dine, Chief Executive Officer of the hotel who talked about the innovation and other issues. The Intercontinental Hotel Rating Forum, (IHRF) last year declared Benin Royal Hotel as ‘A world Class Hospitality Haven in West – Africa”. This is coming against the background that it is built and managed by an African.

Following are the interviews extractedby Wale Ojo during one on one interview with the hotel President

Why do you think your hotel deserves this rating?

My background as hospitality practitioner and a man who has travelled to many cities of the world, berthing in hotels of different brands, grades and star-rating, exposing myself to different culinary tastes, mingling with different peoples on global platforms, attending hospitality conferences, seminars on running hotels and event centres, participating in intercontinental tourism and hospitality shows moulded my thinking, set my vision and situated my gaze about planting this hotel . It is a dream of having an enclosure of bliss, luxury, hospitality, exceptional facilities and cosy ambience. A place you can be proud of. And to Allah be the glory, it is a reality.

It seems the French system has a lot of impact on your outlook particularly in terms of service delivery and customer’s relation. How true is this?

Well, one thing you must understand is the fact that no one can safely live out of his milieu. I am a Beninese by birth and by inclination and invariably a Frenchman by colonisation, language, mode of dressing and culinary taste. However, I am a man of the world with my background as Yoruba Ajase, a man who has travelled and tasted the major continents. The French are good when it comes to hospitality, food and wine, I imbued that culture. I have the traditional value and culture of Yoruba Ajase. I am also grounded in the authentic and original, local value of Benin Republic. All these combined fashioned what I do and plant. Thus, in Benin Royal Hotel, you cannot miss its cosmopolitanism.

Your hotel is regarded as being the most preferred by prominent and distinguished tourists visiting Cotonou from African countries. What is the magnet?

You see, one major vision of this hotel is to offer exceptional services, a brand of which you cannot get its measure anywhere in this country whether of international brand or of the local operation. The vision here from the gateman to the CEO is “a customer is your Lord “And you know how you relate to your Lord with reverence, adoration, utmost respect and keen devotion. Also, we personalised our culinary service. We have the best of the chefs. We served the choice of their taste. Services here are personalised. Our facilities are superb and of the international benchmark. Remember, we parade the latest innovation in fixture and fittings

There is this facility which your hotel has monopolised…

I don’t know the one you are referring to

I remember now, the suspended swimming pool!

Yes. Yes. In our attempt at offering the best facilities and telling the world that whatever you get in London, America, Dubai and South Africa, you can have it here. I was in South Africa, Durban, and I stayed in Holiday Inn, Marine Parade, the swimming pool is on the 35th or 36th floor. There were many hotels in Dubai too, US, Paris with their swimming pool on the rooftop. I love the setting and I realised that distinguished and high calibre patrons like relaxing in arena out of people’s focus, a kind of privacy. This and others are the reasons we located the swimming pool on the sixth floor. And you see, it is with all facilities better than locating it on the ground.There, you get a panoramic view of Cotonou and its environs.

You seem to have a foolproof marketing strategy which lures patrons and customers of high calibre and prominent citizens all over of the world here

I don’t think it is a foolproof strategy. I think it is about our commitment to exceptional service and the high standard of services here. Also, we are in partnership with the international corporate institution which can vouch for us in terms of service delivery and which referrals we have never let down. We formed a synergy with credible intercontinental and transcontinental tourism enhancers and promoters like the one we have signed with Motherland Beckons in Nigeria with Destination Ouidha, being chaperoned by Ambassador Wanle Akinboboye, the man who owns one of the best Beach Resorts in West – Africa located in Ibeju Lekki, Nigeria

Can you let us into Destination Ouidha?

It is the win-win and sequential movement of discerning and corporate tourists from Nigeria to Republic Du Benin which will take them on tour of all the major historical, cultural and religious sites in the country with an emphasis on Ouidha, the Slave Trade town of note and centre of world voodoo. It is also of ensuring a repeat of tourists’ traffic from the Benin Republic to Nigeria. And to tell you how it works, the test run of this intra-regional tourism movement will be held on January 20. And I hope And I hope to see you in Cotonou.