Celebrities

Detailed Guide On How To Read A Depth Chart

Market depth data can be a bit like salt—we barely notice it in our day-to-day lives, but it can matter a lot if it’s missing altogether. As it happens, not all brokers and stock analysis software provide market depth charts. When reading a depth chart, it’s important to consider the impact of hidden liquidity. The term hidden liquidity refers to pending buy or https://www.beaxy.com/ sell offers that have not been factored into the depth chart. Market depth can be evaluated by looking at theorder book of a security, which consists of a list of pending orders to buy or sell at various price levels. On any given day, there may be an imbalance of orders large enough to create high volatility, even for stocks with the highest daily volumes.

Whales can also use large orders to find coins where the pumps &dump can be implemented. Such speculation can be profitable for those familiar with pumping, but it’s dangerous for everyone else. Whales are looking for junk coins with low trading volumes and minimal sell orders. High buyer activity is not necessary for pump-prone coins to grow. Therefore, coins with low volumes and little resistance are used.

How Market Depth Works

It is unlikely the price will break out above it, making it an excellent potential resistance level. The buy and sell walls listed in a depth chart can give you insights into how the in the market are predicting price direction. Thinking about the impact of hidden liquidity when interpreting a market depth chart is crucial.

- Each object in the series array requires a values array to function properly.

- Because it generates numerous sell orders at a single price, a large sell wall prevents bitcoin prices from rising quickly.

- Such speculation can be profitable for those familiar with pumping, but it’s dangerous for everyone else.

- A candlestick chart, also known as a price chart, uses candlestick figures to represent the changes in price between open, close, high, and low.

A day trader dealing with short-term crypto needs to play it smart because whales can manipulate the market. These are traders with so much capital that they can place buy and sell orders at a certain price, large enough to have a low probability of execution. Whales can set lower and upper limits for future price movements. Real buy and sell walls are not formed by the actions of any particular trader.

What is a Buy Wall?

On the price chart, walls formed throughout the trading session may later act as support or resistance. The top bid price and the bottom ask price are of the most interest. Most cryptocurrency exchanges allow you to buy and sell directly from the order book.

On the unofficial depth chart Hogan and Matthews are the other starters, gotta think one of their fantasy draft stocks go up but I would argue NE still hurts at WR even after Edelman returns https://t.co/KaSXvUswRP

— Quinn Lynch (@QLynchCU) July 4, 2018

Market depth considers the overall level and breadth of open orders, bids, and offers, and usually refers to trading within an individual security. A depth chart shows the demand and supply of a specific stock, commodity or currency. The ticks along the vertical axis are the sum of all offers at that price or lower.

Get Started with a Stock Broker

Typically, a buy wall is marked in green and a sell wall is marked in red. The green wall serves as a support for the price of the coin, while the red wall serves as resistance. Keep in mind that trading on the basis of the order book is more suitable for short-term transactions when we are talking a profit of roughly 5%.

Traders may believe the price will not fall below a particular level if there is a high buy wall. A significant buy wall keeps bitcoin prices from falling sharply by generating many buy orders at a single price. All the buy and sell orders on the platform are graphically represented in the depth chart. The X-Axis measures the price, while the Y-Axis measures the number of orders. As soon as you see a vertical line begin to grow on the chart of sell or buy orders, begin to react. If the number of sales rises, prepare for a precipitous drop, if the number of purchases rises.

By selecting “Show Quotes” from the context menu when you right-click on the Depth Chart, you can choose not to display the Quotes section. The right side of the chart shows the cumulative value of the sell orders placed on Bullish at a given price point above the asset pair’s current market price. The ask line represents the cumulative value of the asks, or sell orders, at each price point. Sell orders can be placed in several currencies, depending on a trading pair you choose. For example, if you trade ETH against USDT, bid line would be placed in ETH.

Depth charts are something to essentially show the supply and demand at different prices. A “sell wall” forms when there are a large number of sell orders (“asks”) at a particular price level. Financial markets facilitate the trading of financial assets across many participants. These markets are usually owned by a company who pairs buyers and sellers of different assets and maintains the market’s fairness. Nevertheless, it is also possible to buy a coin that is actively selling, as long as the risk per trade does not exceed 10% of the daily loss limit.

The more unrealized buy orders exist at a given price, the higher the buy wall. A high buy wall ADA can indicate that traders believe the price will not fall below a certain price. A large buy wall prevents bitcoin prices from dropping rapidly because it creates a large amount of buy orders at one price. During a bearish market cycle, buy wall orders may be filled more rapidly than during bullish market cycles due to increased market liquidity. The creation and growth of a buy wall can be influenced by market psychology. Buy and sell walls indicate a significant volume of orders at a given price, and can indicate market trends.

Depth Chart

Market depth is used as a measure of how much one big trade will affect a stock or derivative price. Market depth also can be used by traders to determine when to enter a trade. You can also use this table to determine what prices you will pay for a large order. You would be able to buy 25 shares at $5.10, 50 at $5.30, and 100 at $5.56.

When a significant number of buy and sell orders appear at a particular level, you can expect other traders to place their orders there as well. Buy and sell walls are common for the crypto market, as they reflect the mood of the market’s participants. Walls allow predicting the trading instrument’s behavior in the future, though one should not fully trust them. Let’s boil down some crucial concepts related to buy and sell walls in trading.

The price changes between the open, close, high, and low are shown using candlestick figures on a candlestick chart, also referred to as a price chart. Add this to a few other trading fundamentals and start making profits, even during volatile markets. To trade cryptocurrencies intraday, it is important to have a positive sentiment already in place, which can improve trading results. If the orders are biased in one direction, that can signal in which direction the stock price will move. For example, if 60% of orders are to buy and only 40% are to sell, the price will likely go up due to that buying pressure. This demo shows how you can implement a simple “Order Book” chart using our XYChart.

What does depth mean in stocks?

Depth of market (DOM) is a measure of the supply and demand for liquid, tradeable assets. It is based on the number of open buy and sell orders for a given asset such as a stock or futures contract. The greater the quantity of those orders, the deeper or more liquid, the market is considered to be.

If someone has enough money to manipulate the price of a particular cryptocurrency, there is a high probability that they will try to do so. The presence of this situation portends hard times for a particular cryptocurrency, as a large number of sell orders have accumulated. Selling gradually intensifies, and traders seek the best buy orders. When a sell wall forms in the crypto, you may want to get rid of a long position.

InsideNebraska – Ernest Hausmann, Decoldest Crawford, Brant Banks enter the transfer portal – Rivals.com – Nebraska

InsideNebraska – Ernest Hausmann, Decoldest Crawford, Brant Banks enter the transfer portal.

Posted: Fri, 02 Dec 2022 10:08:01 GMT [source]

It is based on the order book data, that is, the number of open buy and sell orders, including the quantity of the asset. The greater volume of such orders, the more liquid the market for that asset. Market depth data can also be helpful when contemplating entry and exit points for your trades as you have a total overview of the orders pending on the market. For example, if you are trading stock with low volume and want to buy many shares, the market depth data can allow you to guesstimate the average buying price. Market depth can be used to find the support and resistance levels. For example, suppose stock A is trading at $8.50, and the market depth data indicates a massive cumulation of sell orders at $8.75.

In the following section, we explore how retail traders can use this data practically. For example, stock markets like the NASDAQ and the NYSE allow people to buy and sell shares and act as a trusted third party for the trade. In this article, we look at what market depth is, how it works, and how to read and use market depth data—regardless of your trading or investing strategy.

In the past, this data used to be available for a fee, but nowadays most trading platforms offer some form of market depth display for free. This allows all parties trading in a security to see a full list of buy and sell orders pending execution, along with their sizes—instead of simply the best ones. In addition to price levels, market depth considers the order size, or volume, at each price level. Market depth refers to the market liquidity for a security based on the number of standing orders to buy and sell at various price levels. A large sell wall can indicate that many traders do not believe that the price will rise above a certain price level. It is a visual representation of an order book, which is an organized list of pending buy or sell orders of a specific cryptocurrency at different price levels.

With such a tool, major market participants control the actions of low and medium cap traders. Generally, smaller traders use whales buy sell indicators to withstand pressure and deal with sell walls, implying the maximum number of sell orders. Securities with strong market depth will usually have strong volume and be quite liquid, allowing traders to place large orders without significantly affecting the market price. Meanwhile, securities with poor depth could be moved if a buy or sell order is large enough.

- Consequently, markets also allow price discovery to occur—stocks go up and down because of the ever-changing price that market participants are willing to trade them at.

- Any investment decision you make in your self-directed account is solely your responsibility.

- Depth of Market, aka the Order Book, is a window that shows how many open buy and sell orders there are at different prices for a security.

- Level 2 is a trading service consisting of real-time access to the quotations of individual market makers registered in every NASDAQ listed security.

- This table is similar to how a brokerage firm such as InteractiveBrokers or TD Ameritrade would show market depth.

It can be read as a signal of the likely direction of a stock’s price. Rather than risk having to sell at a lower price, they will sell now. The volume of these buy orders is large enough to potentially drive the price up if the trades are executed. The more pending buy orders exist at a given price, the higher the buy wall. On the right side , you can see all the sell limit orders (“asks”) that people have placed.

Celebrities

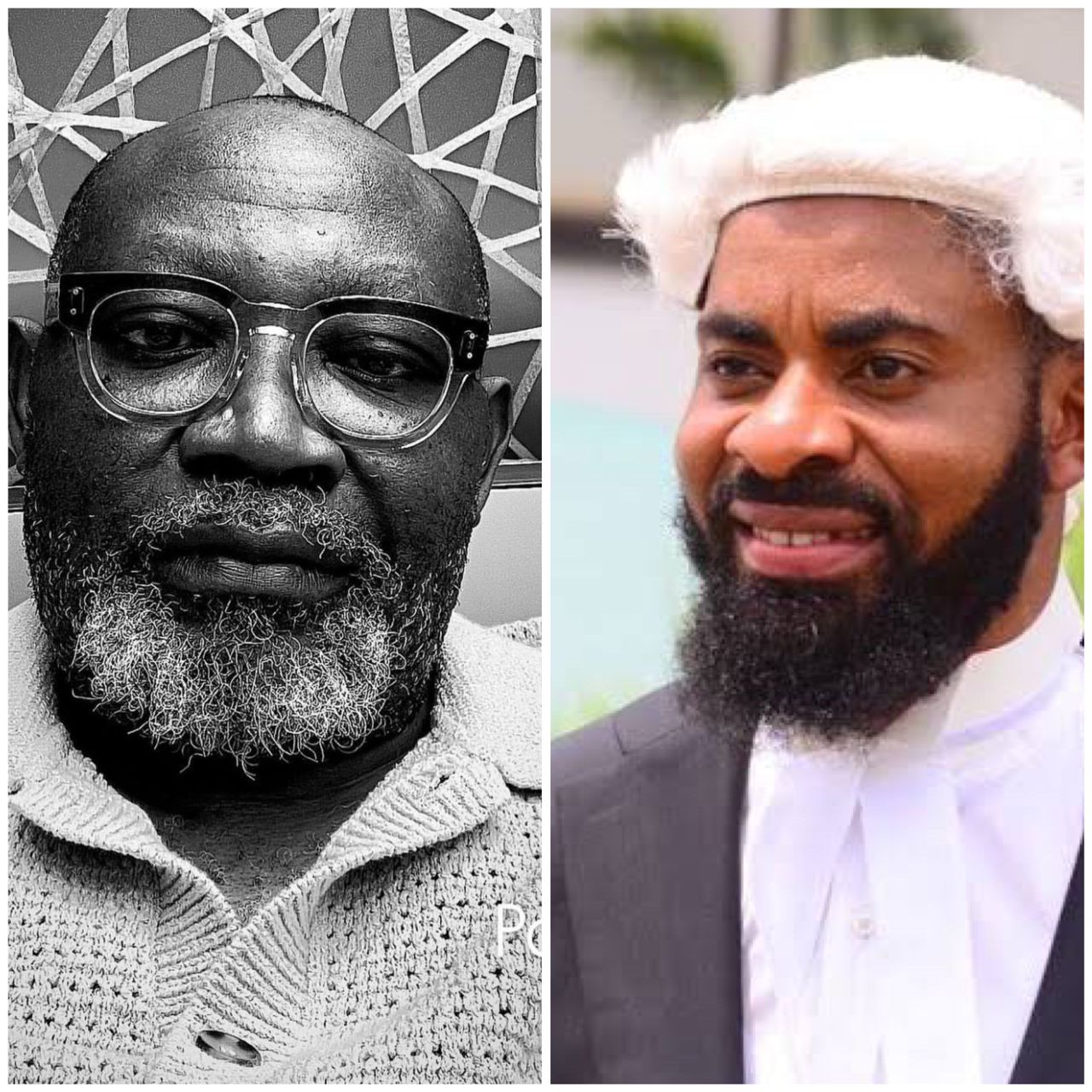

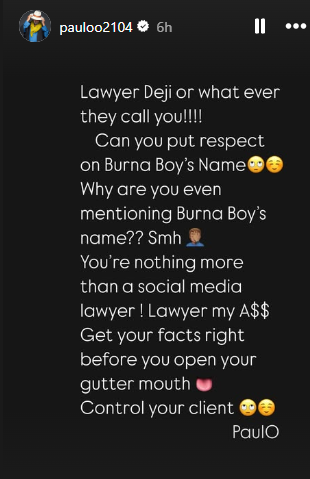

Paulo tackles Deji Adeyanju for linking Burna Boy to Speed Darlington’s arrest

Paulo Okoye, the showbiz promoter, has criticised Deji Adeyanju, the lawyer, for linking Burna Boy to Speed Darlington’s recent arrest.

Deji had announced on social media that his client was arrested by police officers in Owerri, Imo state capital, on November 26.

He also alleged that Burna Boy was responsible for the “harassment” of his client.

In his reaction, Paulo slammed Deji for involving Burna Boy in the incident, accusing the lawyer of being “unprofessional and spreading misinformation”.

The showbiz promoter further demanded that Deji handle his clients more responsibly.

“Lawyer Deji or what ever they call you!!!! Can you put respect on Burna Boy’s Name Why are you even mentioning Burna Boy’s name?? Smh You’re nothing more than a social media lawyer! Lawyer my A** Get your facts right before you open your gutter mouth Control your client,” he wrote.

Deji has not responded to Paulo’s remarks.

Darlington was first arrested in October after posting a video making unsubstantiated claims about Burna Boy.

In the video, Darlington alleged that Burna Boy’s success in the international music scene, including his Grammy win for the album ‘Twice As Tall’ (executively produced by Diddy, the US rapper), was due to an alleged sexual relationship between the two.

Darlington was released on bail on October 9 after spending five days in detention.

Celebrities

‘Morayo can’t grow on me’ — Kess joins critics of Wizkid’s album

Kess Adjekpovu, former Big Brother Naija (BBNaija) housemate, has criticised ‘Morayo’, Wizkid’s fifth studio album.

Last Friday, the Grammy-winning Nigerian singer delivered the album after months of teasing.

‘Morayo’ is a tribute to Jane Dolapo Balogun, Wizkid’s late mother, who passed away in August 2023.

In the project, Wizkid featured Asake, Brent Faiyaz, Jazmine Sullivan, Anaïs, and Tiakola.

Kess shared his thoughts on the new album in a series of X posts on Tuesday.

The reality star said he fell asleep while attempting to listen to the album.

“Decided to listen to ‘Morayo’. Sleep catch me. Up and grateful. ‘Morayo’ still never sweet me. I guess it can’t grow on me,” he said.

https://x.com/Kess_Adjekpovu/status/1860973568026152993?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1860973568026152993%7Ctwgr%5Ee5063e1239484b5feb8c87cc76c8e92addd61c4c%7Ctwcon%5Es1_c10&ref_url=https%3A%2F%2Flifestyle.thecable.ng%2Fbbnaijas-kess-criticises-wizkids-album-morayo%2F

https://x.com/Kess_Adjekpovu/status/1861266328096559330?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1861266328096559330%7Ctwgr%5Ee5063e1239484b5feb8c87cc76c8e92addd61c4c%7Ctwcon%5Es1_c10&ref_url=https%3A%2F%2Flifestyle.thecable.ng%2Fbbnaijas-kess-criticises-wizkids-album-morayo%2F

‘Morayo’ has garnered both praise and criticism from listeners since its release.

While some music lovers have appreciated the project, commending its unique sound and artistic direction, critics have pointed out various aspects of the album that didn’t quite meet their expectations.

Kess was a housemate on season seven of the BBNaija reality show in 2022.

Celebrities

Helen Ukpabio demands N200bn damages in defamation suit against Bloody Civilian

Helen Ukpabio, the founder of Liberty Gospel Church, has demanded N200 billion in damages from the singer Bloody Civilian after the latter alleged that she encourages child lynching.

Earlier on Friday, Bloody Civilian, born Emoseh Khamofu, had alleged that Ukpabio “literally made people burn their children alive”.

Khamofu commented on a post celebrating the cleric’s 60th birthday.

She also posted a YouTube documentary wherein Ukpabio’s methods and ideology were criticised.

Reacting to her tweet, Imabong, Ukpabio’s daughter, threatened to take legal action against Khamofu if she didn’t delete the post.

“I give you the next five hours to take this down, or I will educate you in court!” Imabong wrote.

But in a letter from her legal representative, Ukpabio described the allegations as “reckless, satanic, and libellous”.

She demanded that the singer issue a retraction and public apology on all social media platforms and ten national and international dailies within 72 hours.

The cleric also requested that the singer pay N200 billion as “damages for distress, trauma, pain and anguish”.

The letter added that the demands must be met in 72 hours.

She claimed the allegations had been investigated by the police and have been concluded to be “grossly false”.

“Our client’s attention has been drawn to your reckless, satanic, and libellous posts on X (formerly Twitter), one of the world’s largest social media platforms,” the letter reads in part.

Responding to the letter, Blood Civilian made light of it by teasing that she is offering other services like comedy to afford the damages.

“This December I will be adding the following to my services: weddings, standup comedy and settling disputes,” she wrote.

-

Education3 days ago

Education3 days agoAkwa-Ibom to probe 26 schools as video depicts poor nutrition at boarding house

-

Special Features5 days ago

Special Features5 days agoIyabo Ojo, Brainjotter, Dayo Oketola, Penzaarville, Tomiwa and others to speak at the Bodex Social Media Hangout 5.0

-

Business5 days ago

Business5 days ago31 electricity towers affected as vandals destroy transmission lines in Edo communities

-

Special Features7 days ago

Special Features7 days agoDG ARCON, Dr Olalekan Fadolapo to speak at Bodex social Media Hangout 5.0

-

News3 days ago

News3 days agoLagos state government shuts establishments in Gbagada, Ogudu, others over noise pollution, environmental violations

-

News1 week ago

News1 week agoLagos state government seals Ile Iyan restaurant over waste disposal violations

-

World2 days ago

World2 days ago‘You’ll pay huge price for allowing illegal migrants into US’, says Trump as he vows to punish Canada

-

Politics1 week ago

Politics1 week agoEnugu LGA chairman appoints aides on garden egg, pepper, yam