Business

How to open a domiciliary account in Nigerian banks

With the rising value of the dollar against the naira, many Nigerians are now looking for opportunities to earn foreign currencies, even while still in Nigeria. Fortunately, the gig economy and the growing remote work landscape are making that easier.

This has made opening a domiciliary account necessary for Nigerians more than ever before. But what is a domiciliary account?

A domiciliary account is a bank account that allows you to hold and transact in foreign currencies. It is a useful account to have if you receive or send money abroad, travel frequently, or do business with international clients.

In this article, we take you through the process of opening a domiciliary account in Nigerian banks and the requirements.

What you need to open a domiciliary account

To open a domiciliary account in a Nigerian bank, you will typically need to provide the following documents:

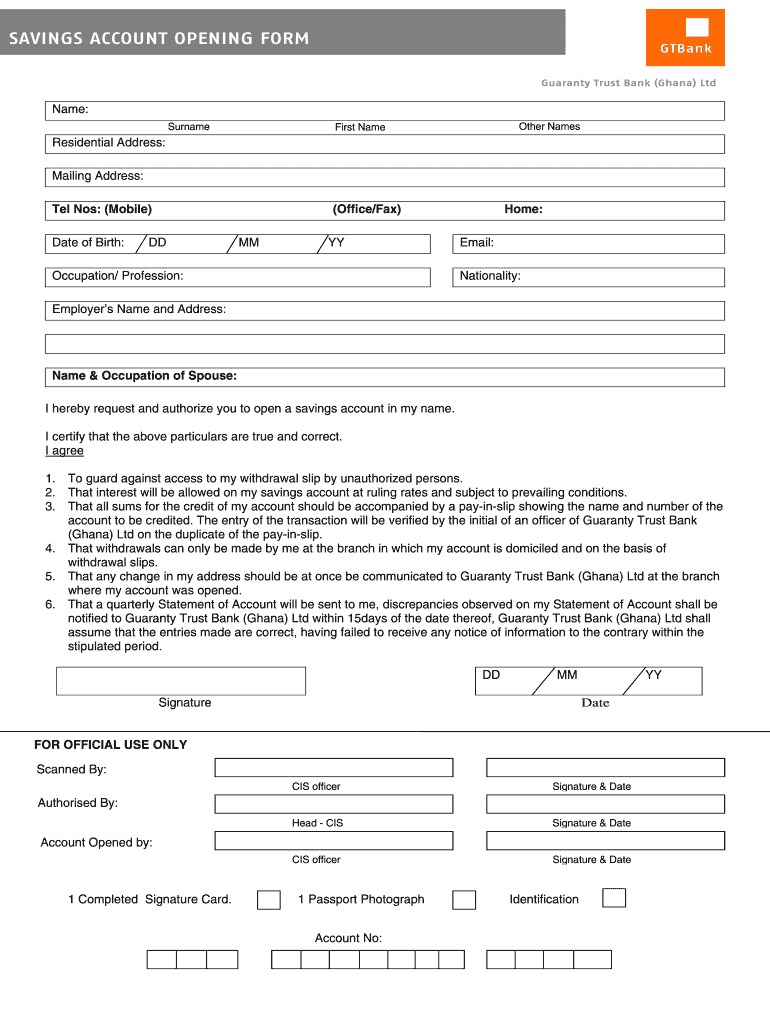

- A completed domiciliary account opening form

- A valid means of identification, such as an international passport, national identity card, or driver’s license

- Recent passport photograph

- Proof of address, such as a recent utility bill

- Two references, who can be friends, family members, or business associates who have known you for at least two years

In addition to the above, some banks may also require you to make an initial deposit into your domiciliary account. The amount of the deposit will vary depending on the bank.

Once you have submitted your documents and made the required deposit, your domiciliary account will be opened. You will then be able to start receiving and sending money in foreign currencies.

Step-by-step approach

The steps below will guide you through the process of opening a domiciliary account:

Choose a bank: There are many different banks in Nigeria that offer domiciliary accounts. Do some research to compare the different banks and choose one that is right for you.

Visit a branch of the bank: Once you have chosen a bank, visit a branch of the bank to open your domiciliary account.

Fill out the domiciliary account opening form: The domiciliary account opening form will ask for your personal information, such as your name, address, date of birth, and occupation. It will also ask for your identification and proof of address documents.

Submit your documents and make the required deposit: Once you have filled out the domiciliary account opening form, submit it to a bank representative along with your identification and proof of address documents. You will also need to make the required deposit into your account.

Wait for your account to be opened: Once you have submitted your documents and made the required deposit, your domiciliary account will be opened. You will then receive a debit card and/or checkbook for your account.

Note that bank charges may also apply on this account and this why it is important to research first about these banks to know which one offers the best terms and conditions for you. It is also advisable to ask the bank representative about any fees or charges that may be associated with your domiciliary account.

Business

Nigeria to stop petrol importation in June, says Dangote

Aliko Dangote, Africa’s richest person, says Nigeria will stop importation of petrol into the country by June.

Dangote spoke at the Africa CEO Forum Annual Summit in Kigali on Friday.

He said the country should end petrol imports by June when Dangote refinery commences production of the product.

“Right now, Nigeria has no cause to import anything apart from gasoline and by sometime in June, within the next four or five weeks, Nigeria shouldn’t import anything like gasoline; not one drop of litre,” he said.

Consequently, Dangote said the shortfall in the supply of petrol will be addressed not only in Nigeria but other West African countries.

“We have enough gasoline to give to at least the entire West Africa. We have enough diesel to give to West Africa and Central Africa,” he said.

Dangote said there is enough aviation fuel to meet the continent’s demands, as well as export to Brazil and Mexico.

Speaking on the commencement of petrol production by the refiner, Dangote said “next month, we will be producing diesel and gasoline”.

He said the refinery would take most African crude grades.

DANGOTE SAYS REFINER WILL NOT FOCUS ONLY ON PETROLEUM PRODUCTS

Dangote said the refiner would not only focus on producing petroleum products.

“Today, our polypropylene and our polyethene will meet the entire demand of Africa and we are doing base oil, which is to do like engine oil,” he said.

“We are doing linear benzyl, which is raw material to produce LLB, which is raw material to produce detergent. We have 1.4 billion population and nobody is producing that in Africa.”

He said all the raw materials detergents are being imported into Africa, adding that the refinery is producing these raw materials to make Africa self-sufficient.

“As I said, give us three and a maximum of four years and Africa will not, I repeat, not import any more fertilizer from anywhere. We will make Africa self-sufficient in potash, phosphate (even if we don’t have enough, there is a lot in Morocco. But we are also looking at the opportunities,” he said

“For our urea, we are at three million tonnes and in the next twenty months, we will be at six million tonnes of urea which is the entire capacity of Egypt.”

The business mogul said the refiner has 650,000 barrels per day, one million tonnes of polypropylene, 590,000 carbon black — the raw materials ink, dyes and others.

Dangote said the second phase of the refinery will start early next year.

Business

Customs FX rate for import duties rises to N1,530/$

The Nigeria Customs Service (NCS) has adjusted the foreign exchange (FX) rate for import duties to N1,530 per dollar.

This represents a 6.13 percent increase compared to the N1,441.58 adopted on May 6.

The rate adopted by customs was observed on Friday on the federal government’s single window trade portal.

Customs typically adopt FX rates recommended by the Central Bank of Nigeria (CBN) for import duties based on trading activities in the official FX market.

It was observed that the NCS rate is marginally lower than the official FX rate of N1,533/$ recorded at the close of trade on May 16.

On May 15, the Nigerian currency depreciated to N1,550 against the dollar at the parallel section of the FX market.

The parallel FX rate declined by 1.95 percent compared to the N1,520/$ reported on May 13.

On May 16, Muda Yusuf, director-general, Centre for Promotion of Private Enterprise (CPPE), advised NCS to set a quarterly exchange rate between N800/$ and N1000/$ for import duties assessment.

Yusuf said the continuous fluctuation affects inflation.

He said setting a fixed rate was necessary to reduce the pass-through effect of heightening trade costs on inflation.

Business

Naira appreciates at parallel market, official window

The naira appreciated in the parallel section of the foreign exchange (FX) market on Friday.

At the Lagos street market, currency traders, also known as bureau de change (BDC) operators, quoted the naira at N1,510 to the greenback.

The traders put the buying price of the dollar at N1,480 and the selling price at N1,510 — leaving a profit margin of N30.

The figure represents an appreciation of N40 or 2.65 percent from the N1,550/$ traded on May 15.

At the FMDQ Exchange, a platform that oversees official foreign exchange (FX) trading in Nigeria, the local currency appreciated by 2.45 percent or N36.66 to N1,497.33/$ on Friday — from N1,533.99/$ on May 16.

During trading hours, an exchange rate of N1,555 to the dollar was the highest rate recorded and the lowest rate was N1,415/$.

At the official window, a daily turnover of $83.50 million was recorded.

On May 16, the Centre for the Promotion of Private Enterprise (CPPE) urged the Central Bank of Nigeria (CBN) to peg the exchange rate benchmark for computation of import duty between N800 and N1,000 per dollar — to be reviewed quarterly.

Muda Yusuf, CPPE’s director-general, said this is important to lessen the pass-through effect of heightening trade costs on inflation.

-

Entertainment1 week ago

Entertainment1 week agoTems announces release date for her debut album ‘Born In The Wild’

-

Religion4 days ago

Religion4 days agoAllow RCCG members attend your schools for free, Lege Miami tells pastor Adeboye

-

Entertainment4 days ago

Entertainment4 days ago“My dating era has come to an end” – Actress Susan Peters shed tears of joy as she hints at remarriage

-

Entertainment1 week ago

Entertainment1 week agoEsther Ogbu narrates how she once slept on the floor for seven days to avoid being sexually molested

-

Business4 days ago

Business4 days agoSMEDAN begins disbursement of N5bn loans to SMEs

-

News1 week ago

News1 week agoLagos state government introduces electronic system for 10-minute approval of building permits

-

Celebrities4 days ago

Celebrities4 days ago‘Superstar no get money for car’ – Speed Darlington mocks Portable following his arrest (Video)

-

Sports6 days ago

Sports6 days agoAmusan sets world leading record in 100m hurdles