Business

Five bad habits that could land you in debt

Being in debt is stressful, can get embarrassing and poses a huge threat to an individual’s financial freedom. Crucial debt can even affect a person’s goal as it must be factored in their every plan.

If you’ve ever had to pay off a debt, even a little, you may relate to the descriptions in the preceding paragraphs.

If you’d like to enjoy a debt-free life then doing away with the habits listed in this article will help you achieve that.

Impulse Spending

Do you go shopping for a specific item but then end up overbuying items out of your initial list? Yes, that happens to a lot of us. But this does not break the bank.

However, it is the habit of spending impulsively which can ruin a person’s finances.

Sometimes, impulse spending can be the rush of excitement you may feel to buy an item or splurge. Oftentimes, we tend to regret having spent on impulse.

Living Without A Budget

Yeah, budgets aren’t just fancy lists to outline your expenses, they’re also important in maintaining financial standards.

By living within a budget, you’ll be sure to avoid sudden expenses which could overtime, welcome debt.

Having No Savings

Savings is a lifestyle habit which encourages a debt-free life.

Whether it’s an emergency fund, short-term, long-term, or a retirement fund, keeping money aside for future purpose is a way to secure future plans.

Identify the kind of savings which works for you and consult with a financial institution or expert to put you through the required procedure.

Living Above Your Means

Unlike the picture you may have in mind of a person living large, living above one’s means is when a person has more than enough income for the basics but the person indulges in eating out, vacations, and overspending on clothes and cars at the expense of future needs such as having adequate retirement savings.

So cut down unnecessary expenses which your income cannot afford and instead try living below your income.

Eating Out All The Time

One of the ways people land into debt is by eating out all the time.

While this may seem unlikely, it really is true. The pricing of food might not seem to take up so much but multiply the money spent on eating out in bulk, and you’d be blown away by how much of your money goes into that.

By cooking and eating homemade food, you’re in a better position to plan a budget around your feeding without breaking the bank. Oh, and nutrition experts said eating homemade food is a healthier option.

Written by Honest Micah

Business

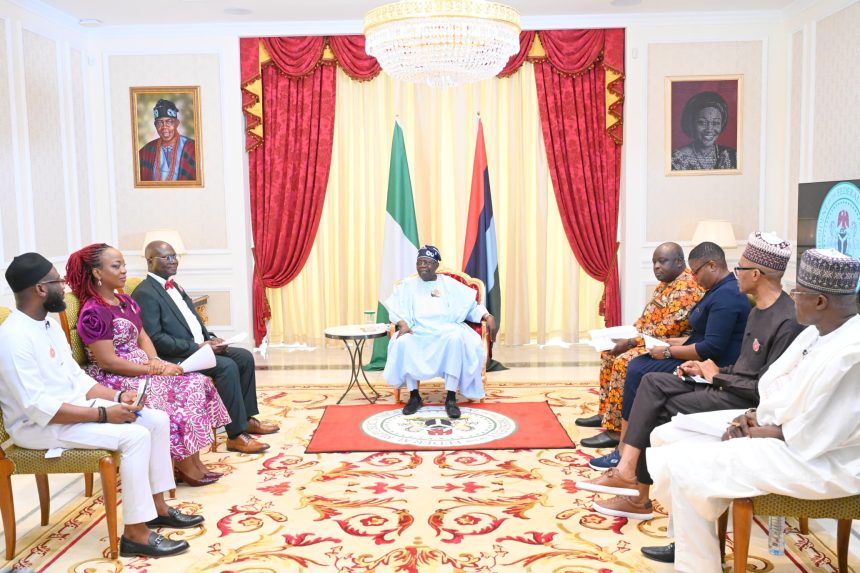

Student loan scheme is part of anti-corruption efforts, says Tinubu

President Bola Tinubu says Nigeria’s new student loan regime could be considered an anti-corruption mechanism.

Tinubu was speaking about his government’s anti-corruption efforts during a presidential media chat that aired on Monday night.

He was asked if he considers anti-corruption an integral element among his governance priorities.

Tinubu said any policy intervention that aims to address the driver of corrupt practices could be considered anti-corruption.

“Corruption, in all its ramifications, is bad. But first, you must pay enough attention to its causes,” the president said.

“Why are the people corrupt? Lack of social amenities, lack of funding for their children’s education. There are so many anti-corruption mechanisms that you can put in place to help the people not be corrupt. Pay them good living wages.

“I have moved from 35,000 to 70,000. To me, that’s anti-corruption. I have given more money to the state and local government levels. I have been transparent with my earnings. Every month, there is a publication on how much this country is making.

“The ability to stem corruption is part of the instrument of the EFCC. That is why they are discovering all sorts of inefficiencies in the system, blocking all the loopholes where anybody can just game the system. That is part of anti-corruption.”

Tinubu said enabling equitable access to tertiary education through a loan scheme is just as important in the anti-corruption struggle.

“The removal of subsidies is also anti-corruption. It is very difficult to say you would eliminate it. You can only reduce it to the barest minimum. Help the people grow. Help them with the education of their children. Our student loan is part of anti-corruption,” he said.

“No parent should lament how to encourage their children in university education. Today, it’s working for a larger part of the population. The society is moving from illiteracy to literacy.

“I enjoy debate on what type of courses are being offered in the university these days to improve science, knowledge, and technology. We continue to work on it. We’re not taking our eyes off these serious matters.”

Business

APPLY: FIRS begins recruitment of senior managers, directors

The Federal Inland Revenue Service (FIRS) has begun its recruitment exercise for experienced professionals to fill specialised positions in the organisation.

Announcing various vacant roles on Monday, the FIRS said the recruitment exercise is part of its consolidation strategies.

The advertised positions include assistant manager and deputy manager roles in tax (investigation), PRS (research), public relations, and ICT (cybersecurity and AI management).

Other available roles are assistant manager and deputy manager in PRS (risk management), assistant manager and deputy manager in legal, and senior manager and assistant director roles in tax (audit).

“Applicants must have qualifications and relevant professional certificates as specified in the positions they are applying for and must also fulfill the following requirements,” the agency said.

“Applicant must possess Bachelor’s degree/HND with at least second class lower/lower credit.

“Applicant must have completed NYSC not later than 31st December 2017.

“Applicant for the position of assistant manager and deputy manager must not be more than 40 years of age while senior manager and assistant director must not be more than 45 as at 31st December 2024.”

The revenue agency said candidates must possess strong leadership and management skills, team spirit and ability to effectively delegate, interpersonal and communication skills, and strong Analytical skills.

“Knowledge of the Nigerian tax laws and appreciation of their application and understanding of the regulatory framework within which the FIRS operates,” the FIRS said.

“Knowledge of business/industry environment within which taxpayers operate.

“Ability to work as a regulator with the courage to ensure full compliance with laws.

“Interested candidates should apply via official FIRS career portal: careers.firs.gov.ng and or FIRS verified social media handles.”

The FIRS said the application portal will open on December 23, 2024, noting that the deadline for submissions is January 11, 2025.

The service advised applicants to carefully review the eligibility criteria before applying to ensure they meet all requirements and understand the qualifications needed for successful selection.

Business

UBA GMD calls for public-private partnership to accelerate economic growth

Oliver Alawuba, group managing director (GMD) and chief executive officer (CEO) of United Bank for Africa (UBA), has called for public-private partnership (PPP) to accelerate economic growth.

Alawuba spoke on December 20 during the launch of the newly renovated departure section of the Murtala Muhammed International Airport (MMIA), Lagos, refurbished by UBA.

According to a statement on Sunday by the bank, the project, which signifies a transformative moment in Nigeria’s aviation sector, shows UBA’s commitment to national development, highlighting the immense value of strategic PPPs.

The ceremony was attended by stakeholders, including Festus Keyamo, minister of aviation and aerospace development, and Olubunmi Kuku, managing director of the Federal Airports Authority of Nigeria (FAAN).

Alawuba commended the collaboration that led to the execution of the project, emphasising the need for public and private institutions to come together to build and revamp the nation’s assets.

“This renovation is a testament of UBA’s belief in the transformative power of investing in national assets. By modernising our airports, we not only enhance infrastructure but also position Nigeria as a global hub for tourism, trade, and investment,” he said.

“Public-private partnerships like this demonstrate what can be achieved when we unite for a shared vision of progress and investing in infrastructure catalyses economic growth, improves travel experiences, and creates opportunities across various sectors of the economy.

“The commissioning of the renovated departure section serves as a reminder of what strategic partnerships can achieve in driving national development and elevating Nigeria’s global standing.”

-

News1 week ago

News1 week agoNaseni’s Executive Vice Chairman, Khalil Suleiman Halilu, Named 2024 Winner Of Daily Global Newspaper Conference Series Award For Science, Technology, Innovation, And Infrastructure

-

Relationships1 week ago

Relationships1 week agoFour dating tips for single mum

-

Relationships6 days ago

Relationships6 days ago‘I wish I met you before the wrong person’ – says Portable’s baby mama, Honey Berry, as she flaunts new lover

-

Business5 days ago

Business5 days agoPoS operators increase withdrawal charges, blame electronic levy, cash scarcity

-

News1 week ago

News1 week agoLagos state government shuts Lord’s Chosen Church, businesses across Lekki, VI, others over noise, environmental infractions

-

Entertainment6 days ago

Entertainment6 days agoBovi speaks against beating children, reveals why his family relocated to UK

-

News1 week ago

News1 week agoTerrorism probe: Finnish authorities freeze Simon Ekpa’s assets

-

Entertainment1 week ago

Entertainment1 week agoPastor Enenche’s daughter, Deborah, husband welcome baby boy two years after marriage