Business

180,000 Traders Lose $520 Million As Bitcoin Falls Below $25,000

Over 180,000 traders lost approximately $520 million as Bitcoin traded below $25,000, a price point, not seen since December 2020 as the market selloff seen throughout the year intensifies. Many have compared the decline in the market to what was seen in the 2008 market crash while others have likened this selloff to the Game of Thrones’ famous episode, “The Red Wedding”.

Bitcoin has fallen below a critical support zone, the $25,000 support zone and with it, liquidation, margin calls and loss of funds have become the order of the day. The entire cryptocurrency market capitalization has fallen approximately 8% as it currently stands below the $1 trillion as of the time of this writing, indicating that the market has lost its trillion-dollar status.

As with bitcoin, so it is with every other altcoin posting declines of 20% and more in the last seven days as the selloff deepens. A major focus has been the CEL token, the native token of Celsius, who has now lost over 50% of its value in just 24 hours as the platform announced it was halting withdrawals.

Business

Transcorp Hotels sells Calabar subsidiary to Eco Travels

Transcorp Hotels Plc says Eco Travels and Tours Limited, an indigenous hospitality company, has acquired its 100 percent stake in Transcorp Hotels Calabar Limited.

According to a statement on April 17 by Stanley Chikwendu, the company’s secretary, Eco Travels and Tours has a diverse portfolio including hotel management, wellness and fitness facilities, family-centric spaces, as well as interior and exterior design and decoration.

“Transcorp Hotels strategic focus is on Abuja and the significant continuing investment in the iconic Transcorp Hilton Hotel and in development opportunities in Lagos,” the company said.

In its published 2023 audited financial statements, Transcorp Hotels — a subsidiary of Transnational Corporation (Transcorp) Plc — recorded 36 percent revenue growth.

With the ongoing execution of its business strategies and optimisation of new business opportunities, Transcorp Hotels said it will continue to create more value for all its stakeholders.

Meanwhile, on January 15, Transnational Hotels joined the trillionaire club in the stock market after their valuation crossed N1 trillion.

As of Thursday, the company’s market capitalisation is valued at N1 trillion.

On March 4, Transnational Corporation announced the listing of its subsidiary, Transcorp Power Plc, on the Nigerian Exchange Limited (NGX).

Business

JUST IN: CBN reduces banks’ LDR to 50%

The Central Bank of Nigeria has announced a review of the loan-to-deposit ratio (LDR) for banks, from 65 percent to 50 percent to align with the current monetary tightening.

LDR is used to assess a bank’s liquidity by comparing its total loans to its total deposits.

An increase in the loan-to-deposit ratio allows banks to expand their credits to businesses and individuals, however, a decline in LDR reduces their ability to loan customers from depositors’ funds.

The CBN disclosed the increase in a circular on Wednesday titled ‘Re: Regulatory Measures to Improve Lending to the Sector of the Nigerian Economy’, signed by Adetona Adedeji, its acting director of the banking supervision department.

“Following a shift in the Bank’s policy stance towards a more contractionary approach, it is imperative to review the loan-to-deposit ratio (LDR) policy to align with the current monetary tightening by the CBN,” the apex bank said.

“Accordingly, the CBN has decided to reduce the LDR by 15 percentage points to 50%, in a similar proportion to the increase in the CRR rate for banks.

“All DMBs are required to maintain this level and are further advised that average daily figures shall continue to be applied to assess compliance.

“While DMBs are encouraged to maintain strong risk management practices regarding their lending operations, the CBN shall continue to monitor compliance, review market developments, and make alterations in the LDR as it deems appropriate.”

Business

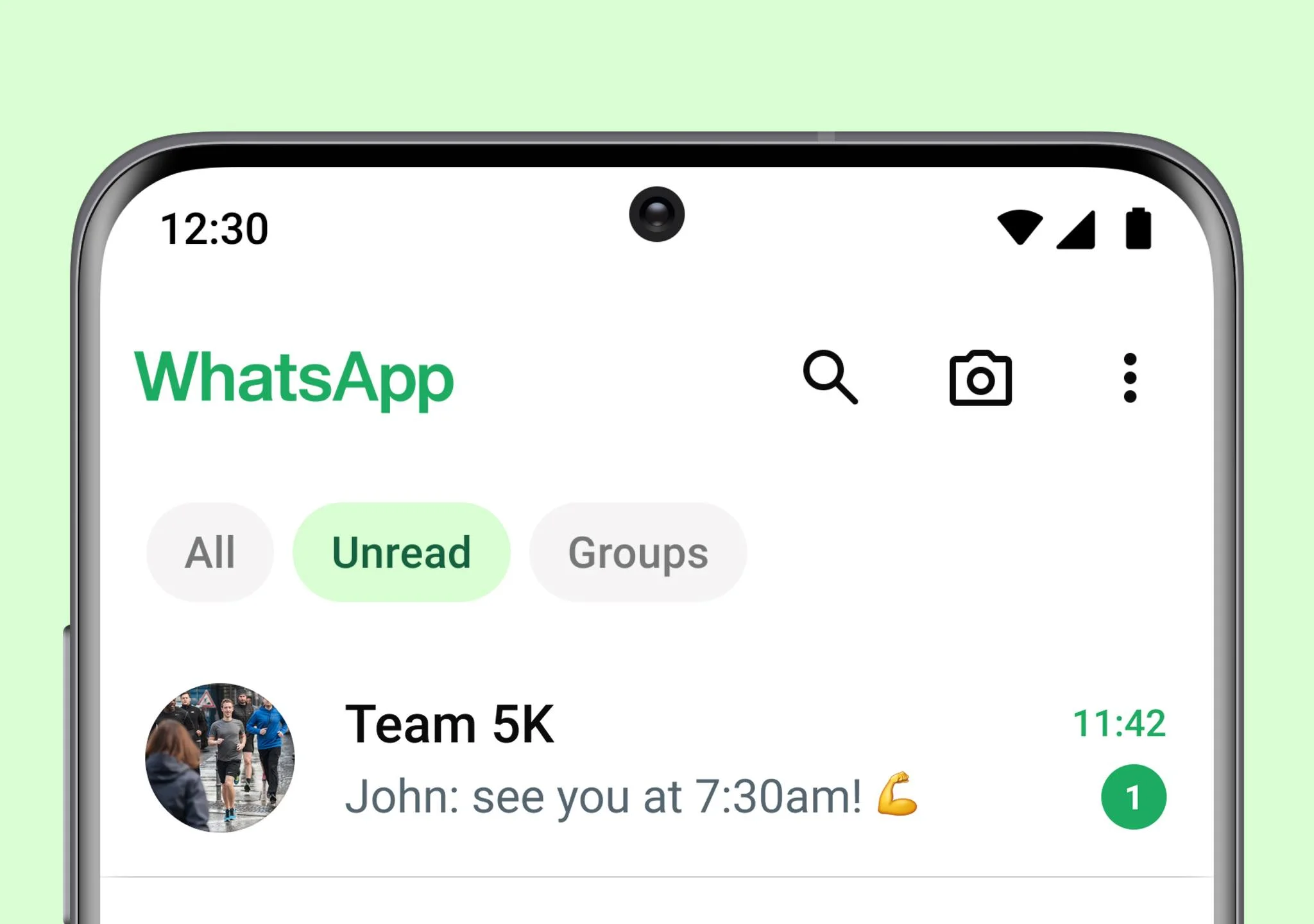

WhatsApp launches chat filters to allow users find messages faster

WhatsApp, the messaging app, has introduced chat filters to allow users to navigate through messages faster and more efficiently.

The Meta-owned platform announced the new feature in a blog post on Tuesday.

WhatsApp said it launched the new feature so that users can get to their important messages without having to scroll through their full inbox.

The social media service said the chat filters have three different features: “All, Unread, and Groups”.

It added that users can choose between any of the three filters that will appear at the top of their chat list.

“Opening WhatsApp and finding the right conversation should feel quick, seamless, and simple,” the post reads.

“As people increasingly do more on WhatsApp, it’s more important than ever before to be able to get to your messages fast.

“We believe filters will make it easier for people to stay organized and find their most important conversations and help navigate through messages more efficiently.

“We will continue to build more options to help you focus on what matters most.”

In recent times, WhatsApp has been actively rolling out new features to enhance user experiences and keep up with evolving communication trends.

In July last year, the Meta-owned firm unveiled an instant video messaging feature.

On August 8, the social network introduced a screen-sharing feature to enhance the video calling experience on its platform.

WhatsApp also introduced a feature that allows users to operate multiple accounts on a single device.

-

Entertainment1 week ago

Entertainment1 week agoBeyonce’s country album tops Billboard chart

-

Education6 days ago

Education6 days agoPrinting of JAMB slip: Beware of fake sites, police warn 2024 UTME candidates

-

News1 week ago

News1 week agoJnr Pope: NIWA rescues 7, recovers two corpses, 3 still missing in Anambra boat mishap

-

Business3 days ago

Business3 days agoX will start charging new users to post, says Elon Musk

-

Entertainment2 days ago

Entertainment2 days agoJUST IN: Cubana Chief Priest pleads not guilty to naira abuse charge

-

Entertainment7 days ago

Entertainment7 days agoAdanma Luke surrenders to police after boat mishap

-

Entertainment1 week ago

Entertainment1 week agoHow Ghanaian Prophet predicted Actor Jnr Pope’s death in 2023 (Video)

-

Entertainment2 days ago

Entertainment2 days agoCubana Chief Priest arrives court for naira abuse trial