Business

We’ve put policies in place to tackle naira depreciation, says CBN

The Central Bank of Nigeria (CBN) says it has established policies to address the persistent depreciation of the naira.

The local currency currently exchanges N440/$1 at the official market but N751/1$ at the parallel market.

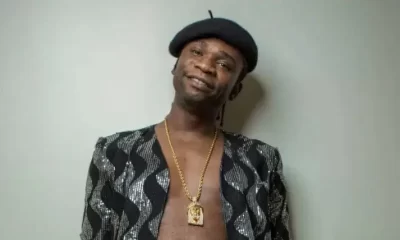

Osita Nwanisobi, director of the apex bank’s corporate communications, said this during a virtual media briefing on Thursday at the end of the bankers’ committee’s meeting.

His statement comes a few days after the Association of Bureau De Change Operators of Nigeria (ABCON) criticised the foreign exchange policy of the Central Bank of Nigeria (CBN)for adversely impacting the naira stability across all markets.

According to the association, the apex bank’s policy created a huge gap between official and parallel market rates.

Speaking with journalists, Nwanisobi said the policies of the apex bank are aimed at boosting foreign exchange inflows to meet citizens’ demands.

While responding to a question on the possibility of the naira falling to N1,000 per dollar at the parallel market before December, he said, “The CBN has put policies in places such as the RT200 FX programme and Naira 4 dollar scheme. These are the measures. If there is a need to adopt more policies, the central bank will not shy away from that.”

Also speaking at the briefing, Ireti Samuel-Ogbu, managing director of Citibank Nigeria, said $1.28 billion was repatriated at the end of the third quarter of the year (Q3) under the RT200 FX programme.

Out of this amount, she said $870 million was sold on the investors’ and exporters’ (I &E) FX window.

She added that during the period under review, eligible non-oil exporters received N42 billion as rebates for the period.