Business

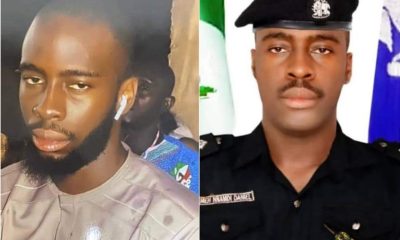

Andrew Yakubu, ex-NNPC GMD, sues EFCC, CBN over refusal to release seized $9.8m

Andrew Yakubu, former group managing director (GMD) of the Nigerian National Petroleum Corporation (NNPC), has sued the Economic and Financial Crimes Commission (EFCC), over an alleged refusal to release his $9.8 million after a court judgment acquitted him of fraud charges.

The Central Bank of Nigeria (CBN) and the Guaranty Trust Bank (GTB) are also respondents in the suit, filed at a federal high court in Abuja.

On February 3, 2017, operatives of the EFCC raided the property of the former NNPC chief in Kaduna and recovered the sum of $9.8 million, and £74,000 stashed in a fire-proof safe.

He was alleged to have omitted the monies from the EFCC asset declaration form given to him to fill in 2015.

Yakubu was arraigned before Ahmed Mohammed, a judge, on March 16, 2017, on a six-count charge bordering on money laundering and false declaration of assets.

However, in March 2022, the judge, discharged and acquitted Yakubu of the charges.

In the originating summons, marked, FHC/ABJ/CS/231/2023, and filed before Inyang Ekwo, another judge, Yakubu through his counsel, Ahmed Raji, is asking the court to determine whether the EFCC ought to still have in its custody his seized monies after the judgment.

He is praying the court for an order directing the defendants to immediately release the monies to him pending the determination of the EFCC’s appeal.

Alternatively, Yakubu wants an order directing the defendants to immediately transfer the said monies into an account under the control of the federal high court’s chief registrar or into an account to be operated by the chief registrar, the EFCC, and him — pending the determination of the appeal.

But the EFCC, in a notice of preliminary objection, prayed the court to dismiss Yakubu’s application.

Faruk Abdullah, EFCC counsel, said the suit was an abuse of court process, adding that the court lacked the jurisdiction to entertain the matter owing to appeals pending before superior courts.

In an affidavit supporting the motion, the EFCC said most of Yakubu’s depositions did not reflect the correct position of the case.

The matter has been adjourned to May 18 for hearing.

Business

Nigeria’s GDP rate grew by 3.46% in Q3 2024, says NBS

The National Bureau of Statistics (NBS) says Nigeria’s annual gross domestic product (GDP) grew by 3.46 percent in the third quarter (Q3) of 2024.

The NBS, in its GDP report published on Monday, said the growth rate is higher than the 3.19 percent recorded in Q2 2024.

Business

Dangote refinery reduces ex-depot price of petrol to N970 for oil marketers

The Dangote Petroleum Refinery has announced a reduction in its ex-depot price of premium motor spirit (PMS), also known as petrol, to N970 per litre for oil marketers.

This is a cut from the refinery’s N990 ex-depot price announced earlier this month, according to a statement on Sunday.

The slash would help marketers save about N20 on each litre of petrol bought from the Lekki-based plant.

Anthony Chiejina, Dangote Group’s chief branding and communications officer, said the move is the refinery’s way of appreciating Nigerians “for their unwavering support in making the refinery a dream come true”.

“In addition, this is to thank the government for their support as this will complement the measures put in place to encourage domestic enterprise for our collective well-being,” the statement reads.

“While the refinery would not compromise on the quality of its petroleum products, we assure you of best quality products that are environmentally friendly and sustainable.

“We are determined to keep ramping up production to meet and surpass our domestic fuel consumption; thus, dispelling any fear of a shortfall in supply.”

Business

Allegation of missing fund untrue, says Access Bank

Access Bank Limited has dismissed as untrue allegations of missing fund and unethical behaviour.

The Bank in a statement said: “Our attention has been drawn to a video on social media wherein allegations of missing funds and unethical behaviour have been made against Access Bank PLC.

“First and foremost, we wish to emphasise that the safety and security of our customers’ funds are core priorities which we take seriously. Second, Access Bank Plc does not engage in or condone any unethical behaviour.

“In the instant case, the allegations of missing funds in the Bank are most untrue and baseless.

“There is no N500million or any other fund or amount missing from the subject customer’s account or from any other customer’s account with us.

“We and other independent stakeholders in the banking industry have thoroughly investigated these allegations and independently arrived at the same conclusions.

“Access Bank PLC operates with the highest ethical standards, and we protect our customers’ interests whilst also respecting privacy laws.

“Consequently, whilst we have engaged and will continue to engage with our customers, we must advise the public not to rely on or believe sensational and unverified claims that are designed to titillate and mislead the public.

“We remain committed to serving our customers.”

-

Celebrities1 week ago

Celebrities1 week agoDaddy Freeze, Akah Nnani clash over Emmanuel Iren

-

Business1 week ago

Business1 week agoLagos state government to commence upgrade of major junctions in Ikeja axis, seeks residents’ cooperation

-

Politics1 week ago

Politics1 week agoDSS operatives arrest man with bags of cash during Ondo guber

-

Special Features3 days ago

Special Features3 days agoIyabo Ojo, Brainjotter, Dayo Oketola, Penzaarville, Tomiwa and others to speak at the Bodex Social Media Hangout 5.0

-

News1 week ago

News1 week agoNnamdi Emeh: Suspect Facing Charges In Court, Process Independent Of Police Influence

-

Health1 week ago

Health1 week agoFive ways to rid your home of ants

-

News1 week ago

News1 week agoAlice Loksha, abducted UNICEF nurse, escapes captivity after 6 years

-

Politics1 week ago

Politics1 week agoAiyedatiwa takes commanding lead in Ondo guber poll after winning 15 of 18 LGAs