Business

NNPC announces new nationwide fuel prices, effective immediately

In a significant development, the Nigerian National Petroleum Company (NNPC) Limited has officially revealed the new price range for Premium Motor Spirit (PMS), commonly known as fuel or petrol.

Effective immediately, the prices have been set at ₦488 and ₦555 per litre at the peak, signaling the end of the fuel subsidy era.

The decision comes shortly after the newly elected President, Asiwaju Bola Ahmed Tinubu, made the declaration to terminate fuel subsidy in Nigeria. The termination has caused ripples in the downstream sector of the country’s petroleum industry.

Earlier reports from this newspaper had highlighted indications of an imminent spike in petrol prices. A leaked document had revealed a troubling retail price of over ₦500 per litre, which had caused confusion and concern in the industry.

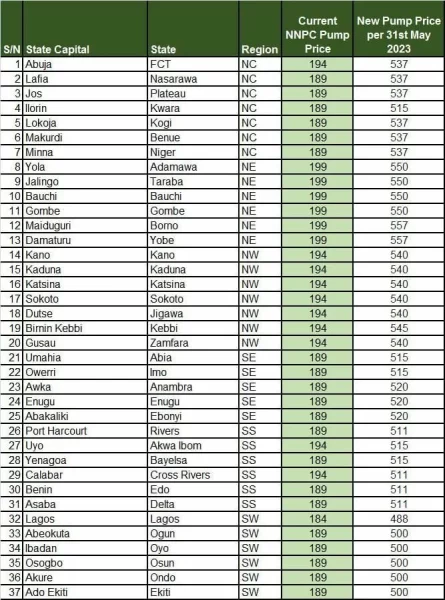

During a meeting held by NNPC stakeholders on Wednesday morning, it was agreed upon and approved by the management to revise the NNPC PMS pump price table for Mega/Standard/Leased Stations. Subsequently, all marketers were instructed to adjust the retail prices of petroleum products across different states.

Contrary to earlier assumptions that the fuel price determination would be delayed, the management has now released a new table of retail prices for various geopolitical zones in the country. Marketers have been directed to implement these changes immediately from Wednesday, May 31, 2023.

In an official statement to the press, the management stated, “Please implement meter change as approved, effective today, May 31, 2023. Wayne is to attend to all locations as relates to their area of coverage in our network.”

Under the revised price schedule, the highest petrol prices will be observed in Maiduguri and Damaturu, where it will be sold at ₦557 per litre. In the rest of the Northeast zone, the price will be ₦550 per litre.

In the Northwest zone, Benni Kebbi will witness the highest prices at ₦545 per litre. The North Central zone is set to experience an average price of ₦537 per litre, except for Illorin, where it will be sold at ₦515 per litre. Consumers in the Southeast region can expect to pay an average of ₦520 per litre.

With the exception of Uyo and Yenegoa, where petrol will now be priced at ₦515 per litre, the rest of the Southsouth zone will receive the product at ₦511 per litre.

Consumers in Lagos will enjoy the lowest price, as petrol will be sold at ₦488 per litre. The rest of the Southwest zone will have access to the product at ₦500 per litre.