Business

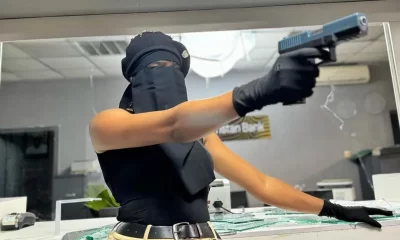

‘Gold card ATM limit now $1,000’ — UBA reviews transactions on domiciliary accounts

United Bank for Africa (UBA) has adjusted its domiciliary MasterCard limits and fees.

In a notice sent to customers, the financial institution said the move is part of its commitment to keep customers updated on changes that may impact their service.

Outlining the new limits, UBA said for its euro cards, the daily automated teller machine (ATM) withdrawal limit on its gold MasterCard is €1,000, the daily web limit is €3,000, and the daily point of sale (POS) limit is €3,500.

For its platinum MasterCard, the bank said the daily ATM limit is €1,500, daily web limit is €5,000, and daily POS limit is €5,000.

Also, UBA said its world MasterCard has a daily ATM limit of €1,500, web limit of €8,500, and POS limit of €15,000.

For its pound cards, the bank put its daily ATM limit for gold, platinum, and world MasterCards at £1,200.

According to the outline, the daily web limit for gold cards is £3,000, platinum card is £5,000, and world MasterCard is £7,500.

UBA said customers would get £3,000 for the daily POS withdrawal limit on their gold card, £5,000 on platinum cards, and £15,000 on world MasterCards.

For dollars, the bank capped its ATM limit for gold at $1,000, while plantium and world MasterCards users would not be able to withdraw more than $1,500, respectively per day.

According to UBA, the daily web limit for a gold MasterCard is $5,000, platinum card is $6,000, and a world card is $10,000.

The bank said its daily ATM POS limit is $5,000 for gold MasterCard users, $10,000 for platinum customers, and $20,000 for world MasterCard users.

Meanwhile, the bank said ATM cash withdrawal or POS cash advance fee will attract “0.6 percent of transaction amount subject to a minimum of $3.5 or equivalent per withdrawal (VAT Exclusive)”.

UBA said 2.5 percent of the transaction amount would be payable when a card is used for other currency transactions.

For short message service (SMS), customers will pay $0.01/equivalent in other currencies.

The review by UBA comes after International Money Transfer Operators (IMTOs) disclosed in a report on February 9, that they would halt dollar transfers to Nigerians due to a directive from the Central Bank of Nigeria (CBN).

“In compliance with a recent directive from the Central Bank of Nigeria (CBN), we regret to inform you that Sendwave, along with all money transfer operators, is no longer able to support USD transfers to Nigeria. We’d encourage you to switch to sending Naira transfers instead,” Sendwave said.

Another IMTO, Worldremit, said transfers would not be paid out in dollars.

Business

NNPC announces downtime on recruitment portal over unprecedented traffic

The Nigerian National Petroleum Company (NNPC) Limited has announced that its job application portal is currently experiencing downtime due to an ‘unprecedented’ surge in traffic.

On Friday, NNPC announced a recruitment exercise for qualified candidates, with the application period set to close on August 20.

Checks by Vanguard revealed that the agency’s website is displaying server error messages.

In response via X, NNPC stated that their technical team is actively working to resolve the issue.

“Due to unprecedented traffic to the NNPC Ltd. career page from applicants applying for vacancies, the site is currently experiencing slow load times,” the statement reads.

“Our technicians are working diligently to rectify the problem as quickly as possible. Please be assured that the application process deadline remains August 20, 2024.”

NNPC also reassured applicants of a transparent and merit-based recruitment process, urging capable Nigerians to take advantage of this unique opportunity.

Business

Zenith Bank seeks NGX approval to sell 5bn shares through rights issue

Zenith Bank Plc has sought approval from the Nigerian Exchange (NGX) Limited to sell 5.23 billion shares through rights issue to raise N188.37 billion.

According to a statement on Wednesday signed by Godstime Iwenekhai, head of the issuer regulation department at NGX, the qualification date for the rights issue is July 24.

NGX said Zenith Bank applied for the approval through Stanbic IBTC Stockbrokers Limited, the lender’s its stockbroker.

The capital market regulator said Zenith Bank plans to list a rights issue “of Five Billion, Two Hundred and Thirty-Two Million, Seven Hundred and Forty-Eight Thousand, Nine Hundred and Sixty-Four (5,232,748,964) ordinary shares of 50 Kobo each at N36.00 per share on the basis of one (1) new ordinary share for every six (6) existing ordinary shares held as at the close of business on Wednesday, 24 July 2024″.

On April 12, Zenith Bank announced plans to raise an undisclosed amount in the international and Nigerian capital markets.

According to the company, the funds shall be raised through the issuance of ordinary shares, or preference shares, whether by way of private placement, rights issue or both.

The company also said the board would propose increasing its issued share capital — from N15,698,246,893.50 to N31,396,493,787 — at the AGM.

Zenith Bank’s plan to raise capital comes after the Central Bank of Nigeria (CBN), on March 28, directed commercial, merchant and non-interest banks to increase their minimum capital requirements.

CBN adjusted the capital base for commercial banks with international licences to N500 billion, while national and regional financial institutions’ capital bases were pegged at N200 billion and N50 billion, respectively.

With a capital base of N270.75 billion, Zenith Bank needs N229.25 billion to reach the minimum capital requirement of N500 billion.

Business

‘600k households paid’ as FG resumes cash transfer scheme

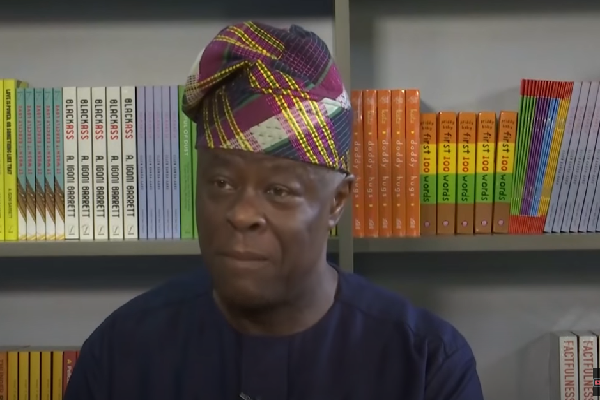

Wale Edun, the minister of finance, says over 600,000 households have benefited from the direct cash transfer programme of the federal government following the resumption of payments.

Edun spoke on Thursday in Abuja during the half-year review ministerial press briefing, themed, ‘Economic Recovery and Growth: Progress and Prospects 2024’.

On July 18, 2023, President Bola Tinubu ordered an immediate review of the conditional cash transfer scheme — an intervention initiative coordinated by the national social investment programme agency (NSIPA).

The president later suspended all programmes administered by NSIPA for six weeks, as part of a probe of alleged malfeasance in the management of the agency and its programmes.

During a radio interview session in Kaduna, Mohammed Idris, the minister of information and national orientation, disclosed the federal government’s plan to resume the intervention schemes.

Speaking at the press briefing, the minister reiterated Tinubu’s commitment to the welfare of ordinary Nigerians and the government’s efforts to ensure transparency and accountability in its social protection initiatives.

“Following the resumption of payments, over 600,000 households have already received this direct transfer this week,” Edun was quoted as saying in a statement by in a statement on by Mohammed Manga, the ministry’s director of information and public relations.

Edun said the government has made significant strides in its economic reforms, “well on its way to achieving a step-change in the revenues of the government; closely in line with the budget for 2024”.

He also announced the government’s exit from the ways and means borrowing mechanism, highlighting successes of the government’s reforms while citing a projected budget deficit of 4 percent in the 2024 fiscal year.

Edun acknowledged the temporary hardships caused by the reforms but assured that Nigerians would soon benefit from the expected outcomes.

He said the government’s “well-coordinated economic policies are beginning to yield results, evidenced by the deceleration in inflation growth, a rise in foreign investments compared to the same period last year”.

The minister said one of the major priorities of the incumbent government in the immediate term is to reduce food prices and focus on providing all the necessary support to increase local food production, given the impact of high food prices on inflation.

He said efforts are underway to achieve this goal.

The minister said with the outcome of the first half of 2024, “the economy is turning the corner.”

Edun added that with macroeconomic stability, the economy is being well positioned for sustained and inclusive growth that creates jobs, lifts millions out of poverty, and drives domestic and foreign investments that would improve the general wellbeing of the average Nigerian.

-

Health7 days ago

Health7 days agoWhat to eat and avoid when treating malaria

-

World1 week ago

World1 week agoComputer scientist claiming invention of Bitcoin faces criminal investigation in UK

-

Politics1 week ago

Politics1 week agoSenator Monguno replaces Ndume as Senate Chief Whip

-

Celebrities1 week ago

Celebrities1 week agoMohbad’s wife claims Joseph Aloba is her son’s greatest enemy

-

Politics1 week ago

Politics1 week agoAppeal court affirms Douye Diri as Bayelsa governor

-

Politics1 week ago

Politics1 week agoActress Hilda Dokubo suspended as Labour Party’s Rivers chairperson

-

Entertainment1 week ago

Entertainment1 week agoRema’s ‘HEIS’ sets record for biggest opening week on Spotify Nigeria in 2024

-

Politics1 week ago

Politics1 week agoOndo LP Governorship candidate, Dr Ayodele Olorunfemi promises ₦120k minimum wage if elected