Business

11 powerful women heading banks in Nigeria

Historically, the Nigerian banking sector is male-dominated, just like several other professional spheres, with women only left to scramble for lower management positions.

This gender bias constituted a worrying glass ceiling that has, over the years, stifled the growth of the female gender in the banking sector.

However, recent trends have shown that women have broken through the barrier to claim their rightful position among their male counterparts.

On Tuesday, March 19, 2024, Zenith Bank announced Dr Adaora Umeoji as its new and first female Chief Executive Officer (CEO).

Umeoji’s appointment was greeted with pomp and pageantry by many Nigerians, particularly staff and stakeholders of the bank.

Amid this development, Pulse presents to you a list of women who are heading banks in Nigeria.

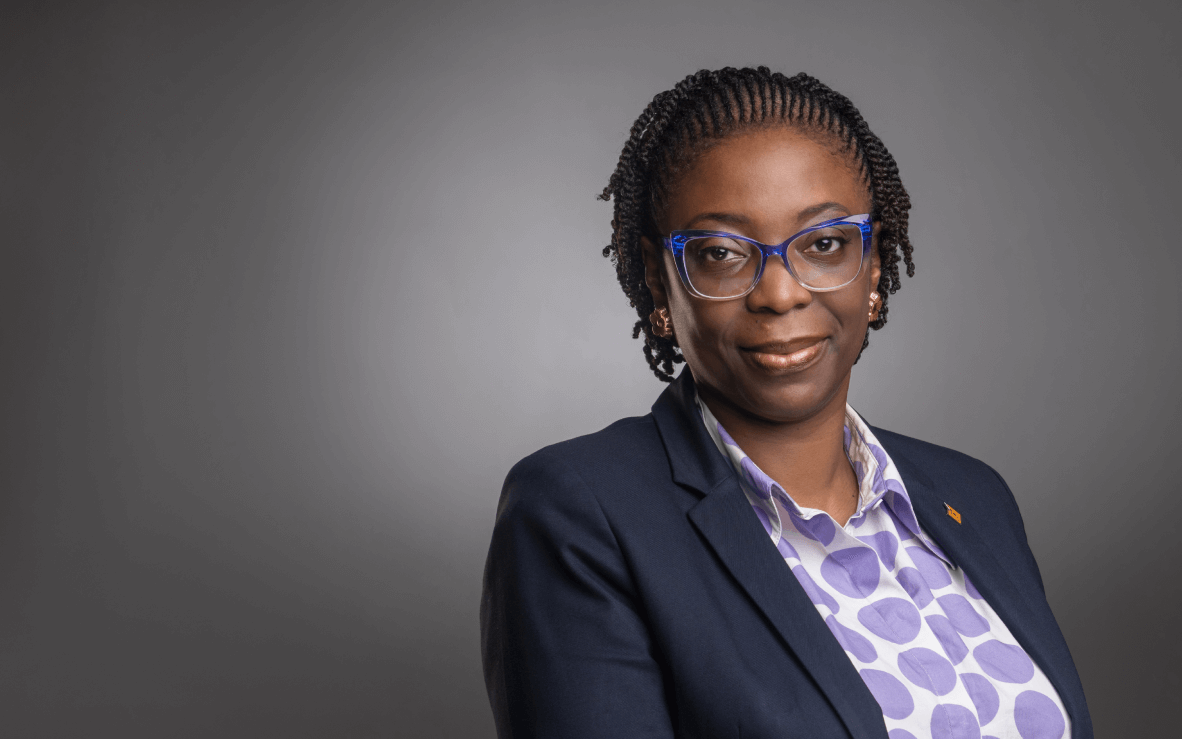

1. Zenith Bank – Adaora Umeoji

Subject to the approval by the Central Bank of Nigeria (CBN), Umeoji will step into the role of the Group Managing Director/Chief Executive of Zenith on June 1, 2024. The accomplished banker with sectoral experience spanning three decades will take over from Dr. Ebenezer Onyeagwu, whose five-year term expires on May 31, 2024.

Umeoji reached the zenith of her career, having climbed the corporate ladder with great dedication and zeal.

She has been with Zenith Bank for 26 years and has held the position of Deputy Managing Director of the bank since October 28, 2016, until her latest appointments.

2. GTBank – Olusanya Miriam

In comes another banking Amazon, whose panache and tenacity shunted her to the top of her career. Miriam is the Managing Director of Guaranty Trust Bank (Nigeria) Limited, a subsidiary of Guaranty Trust Holding Company Plc (GTCO), a position she assumed in July 2021.

She rose from an Executive Trainee at the bank in 1998 to the upper echelon, with experience that cuts across Asset and Liability Management, Financial Markets, Corporate Finance, Investment Banking, Investor Relations and Transaction Services.

3. Fidelity Bank – Nneka Onyeali-Ikpe

After playing an integral role in the bank’s transformation over six years, Onyeali-Ikpe assumed the office as Managing Director/CEO at Fidelity Bank on January 1, 2021.

Before her appointment, she was the Executive Director of Lagos and South West, overseeing the bank’s business in the six states that make up the South West region.

Onyeali-Ikpe is a consummate professional with over 30 years of experience, cutting her teeth at various banks, including Standard Chartered Bank, Zenith Bank and Citizens International Bank, where she held several management positions.

4. Union Bank – Yetunde Oni

On January 10, 2024, the CBN announced the appointment of Oni as the new Managing Director/Chief Operating Officer of Union Bank plc, following an earlier dissolution of the bank’s Board and Management.

The University of Ibadan graduate of Economics comes to the job with over three decades of experience across various banks in Nigeria and abroad.

Oni holds the bragging right of being the first female CEO of the Standard Chartered Bank in Sierra Leone, a position she took in January 2021 until the CBN appointment.

5. Access Holdings – Bolaji Agbede

Agbede stepped in as the Acting Group Chief Executive Officer of Access Holdings Plc following the demise of Herbert Wigwe in a tragic helicopter crash in the United States.

She is a versatile professional with over 27 years of cognate experience in Human Resources management, customer relationship management and banking operations.

Agbede’s banking journey started at GTBank in 1992, where she joined as an Executive Trainee.

However, she rose through the ranks, serving in various capacities, including Relationship Manager and Vault Custodian, before eventually joining Access Bank in 2003 as an Assistant General Manager.

6. FCMB – Yemisi Edun

Edun was appointed Managing Director/Chief Executive Officer of the First City Monument Bank (FCMB) in July 2021, becoming the first woman ever to hold the position.

She joined FCMB in 2000 as Divisional Head of Internal Audit and Control before assuming the role of Chief Financial Officer of the Bank.

Before her banking sojourn, Edun’s career took off at the Akintola Williams Deloitte (member firm of Deloitte Touche Tohmatsu) in 1987, where she worked on corporate finance activities and audit of banks and other financial institutions.

7. Unity Bank – Tomi Somefun

Somefun is one of the trailblazers and pacesetters for women in the banking sector, climbing to become the Managing Director/CEO of Unity Bank Plc in 2015.

Before her appointment, she was the Executive Director overseeing the Lagos and South-West Business Directorates, the Financial Institution Division and the bank’s Treasury Department.

Somefun boasts 35 years of professional career, over 26 years of which were in the banking sector.

8. Citibank – Ireti Samuel-Ogbu

After 26 years of operating in Africa’s largest economy, Citigroup Inc. appointed Samuel-Ogbu as its first female Country Officer for Nigeria in August 2020.

She is currently the CEO & Country Officer for Nigeria and Ghana at Citibank/Citigroup Inc.

Samuel-Ogbu was the Europe, Middle East and Africa (EMEA) Head of Payments and Receivables, Treasury and Trade Solutions (TTS) under Citi’s Institutional Clients Group (ICG) based in London, UK, before she was appointed MD/CEO.

9. Suntrust Bank – Halima Buba

A seasoned banker with over 22 years of cognate experience obtained from working in various banks, Buba is currently the Managing Director/Chief Executive Officer of SunTrust Bank Nigeria Limited.

Before assuming the position in January 2021, Halima was a co-founder and former Executive Director of Taj Consortium, an organisation of young, dynamic technocrats and financial advisory experts.

10. Lotus Bank – Kafilat Araoye

Kafilat is reputed as a banker with long and diverse work experience in various leadership positions in the industry, with emphasis on International and Domestic Operations, Payments, General Management, Business Development, Risk Management, Human Resources and Strategy.

Having left as the General Manager of GTBank in 2015, after a spell that started in 1990, Kafilat was appointed the MD Designate for LOTUS Bank in 2018.

Since then, she has been steering the bank’s affairs, deploying her over 25 years of expertise to stimulate growth and maintain stability.

11. FSDH Merchant Bank – Bukola Smith

Smith became the Managing Director/Chief Executive Officer of FSDH Merchant Bank in April 2021, bringing with her over 25 years of progressive experience in the banking industry with a track record of strategic execution and leadership.

Business

NNPC announces downtime on recruitment portal over unprecedented traffic

The Nigerian National Petroleum Company (NNPC) Limited has announced that its job application portal is currently experiencing downtime due to an ‘unprecedented’ surge in traffic.

On Friday, NNPC announced a recruitment exercise for qualified candidates, with the application period set to close on August 20.

Checks by Vanguard revealed that the agency’s website is displaying server error messages.

In response via X, NNPC stated that their technical team is actively working to resolve the issue.

“Due to unprecedented traffic to the NNPC Ltd. career page from applicants applying for vacancies, the site is currently experiencing slow load times,” the statement reads.

“Our technicians are working diligently to rectify the problem as quickly as possible. Please be assured that the application process deadline remains August 20, 2024.”

NNPC also reassured applicants of a transparent and merit-based recruitment process, urging capable Nigerians to take advantage of this unique opportunity.

Business

Zenith Bank seeks NGX approval to sell 5bn shares through rights issue

Zenith Bank Plc has sought approval from the Nigerian Exchange (NGX) Limited to sell 5.23 billion shares through rights issue to raise N188.37 billion.

According to a statement on Wednesday signed by Godstime Iwenekhai, head of the issuer regulation department at NGX, the qualification date for the rights issue is July 24.

NGX said Zenith Bank applied for the approval through Stanbic IBTC Stockbrokers Limited, the lender’s its stockbroker.

The capital market regulator said Zenith Bank plans to list a rights issue “of Five Billion, Two Hundred and Thirty-Two Million, Seven Hundred and Forty-Eight Thousand, Nine Hundred and Sixty-Four (5,232,748,964) ordinary shares of 50 Kobo each at N36.00 per share on the basis of one (1) new ordinary share for every six (6) existing ordinary shares held as at the close of business on Wednesday, 24 July 2024″.

On April 12, Zenith Bank announced plans to raise an undisclosed amount in the international and Nigerian capital markets.

According to the company, the funds shall be raised through the issuance of ordinary shares, or preference shares, whether by way of private placement, rights issue or both.

The company also said the board would propose increasing its issued share capital — from N15,698,246,893.50 to N31,396,493,787 — at the AGM.

Zenith Bank’s plan to raise capital comes after the Central Bank of Nigeria (CBN), on March 28, directed commercial, merchant and non-interest banks to increase their minimum capital requirements.

CBN adjusted the capital base for commercial banks with international licences to N500 billion, while national and regional financial institutions’ capital bases were pegged at N200 billion and N50 billion, respectively.

With a capital base of N270.75 billion, Zenith Bank needs N229.25 billion to reach the minimum capital requirement of N500 billion.

Business

‘600k households paid’ as FG resumes cash transfer scheme

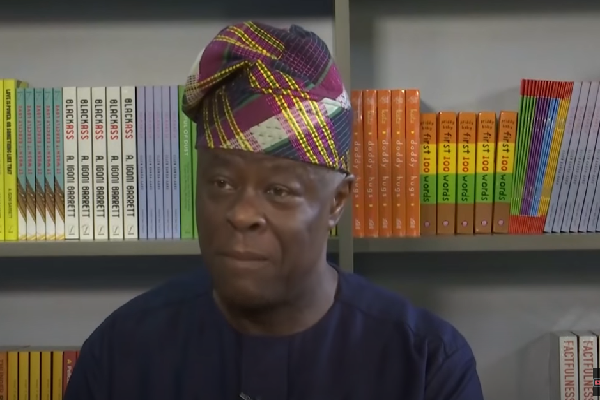

Wale Edun, the minister of finance, says over 600,000 households have benefited from the direct cash transfer programme of the federal government following the resumption of payments.

Edun spoke on Thursday in Abuja during the half-year review ministerial press briefing, themed, ‘Economic Recovery and Growth: Progress and Prospects 2024’.

On July 18, 2023, President Bola Tinubu ordered an immediate review of the conditional cash transfer scheme — an intervention initiative coordinated by the national social investment programme agency (NSIPA).

The president later suspended all programmes administered by NSIPA for six weeks, as part of a probe of alleged malfeasance in the management of the agency and its programmes.

During a radio interview session in Kaduna, Mohammed Idris, the minister of information and national orientation, disclosed the federal government’s plan to resume the intervention schemes.

Speaking at the press briefing, the minister reiterated Tinubu’s commitment to the welfare of ordinary Nigerians and the government’s efforts to ensure transparency and accountability in its social protection initiatives.

“Following the resumption of payments, over 600,000 households have already received this direct transfer this week,” Edun was quoted as saying in a statement by in a statement on by Mohammed Manga, the ministry’s director of information and public relations.

Edun said the government has made significant strides in its economic reforms, “well on its way to achieving a step-change in the revenues of the government; closely in line with the budget for 2024”.

He also announced the government’s exit from the ways and means borrowing mechanism, highlighting successes of the government’s reforms while citing a projected budget deficit of 4 percent in the 2024 fiscal year.

Edun acknowledged the temporary hardships caused by the reforms but assured that Nigerians would soon benefit from the expected outcomes.

He said the government’s “well-coordinated economic policies are beginning to yield results, evidenced by the deceleration in inflation growth, a rise in foreign investments compared to the same period last year”.

The minister said one of the major priorities of the incumbent government in the immediate term is to reduce food prices and focus on providing all the necessary support to increase local food production, given the impact of high food prices on inflation.

He said efforts are underway to achieve this goal.

The minister said with the outcome of the first half of 2024, “the economy is turning the corner.”

Edun added that with macroeconomic stability, the economy is being well positioned for sustained and inclusive growth that creates jobs, lifts millions out of poverty, and drives domestic and foreign investments that would improve the general wellbeing of the average Nigerian.

-

Health7 days ago

Health7 days agoWhat to eat and avoid when treating malaria

-

Politics1 week ago

Politics1 week agoSenator Monguno replaces Ndume as Senate Chief Whip

-

World1 week ago

World1 week agoComputer scientist claiming invention of Bitcoin faces criminal investigation in UK

-

Celebrities1 week ago

Celebrities1 week agoMohbad’s wife claims Joseph Aloba is her son’s greatest enemy

-

Politics1 week ago

Politics1 week agoAppeal court affirms Douye Diri as Bayelsa governor

-

Politics1 week ago

Politics1 week agoActress Hilda Dokubo suspended as Labour Party’s Rivers chairperson

-

Politics1 week ago

Politics1 week agoOndo LP Governorship candidate, Dr Ayodele Olorunfemi promises ₦120k minimum wage if elected

-

Entertainment1 week ago

Entertainment1 week agoRema’s ‘HEIS’ sets record for biggest opening week on Spotify Nigeria in 2024