News

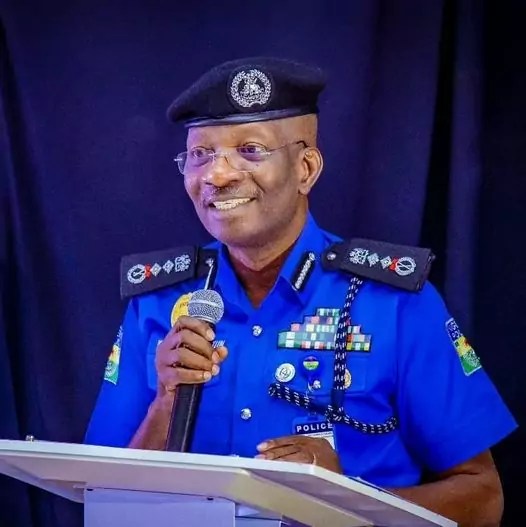

IGP bans use of POS machines in stations, force facilities nationwide

Kayode Egbetokun, the inspector-general of police (IGP), has prohibited the use of point of sale (POS) machines “within the premises of police stations and facilities” across the country.

Olumuyiwa Adejobi, police spokesperson, who announced the ban in a statement on Monday, said it also includes “other electronic mobile money transaction devices”.

Adejobi said the development was prompted by “public outcry on alleged illegal and illicit transactions through POS machine operators and connivance with certain police operatives”.

He added that the prohibition is aimed at “forestalling perceived corrupt practices” and “maintaining discipline within the Force”.

“The Nigeria Police Force, following public outcry on alleged illegal and illicit transactions through point-of-sale (POS) machine operators and connivance with certain police operatives, hereby reiterates the ban on the utilization of POS machines and other electronic mobile money transaction devices within police stations and other police facilities nationwide,” the statement reads.

“The ban is aimed at preserving the integrity and security of police operations, forestalling perceived corrupt practices, as well as clearing the Commands/Formations of possible criminal intrusion under such guise, and maintaining discipline within the Force.”

Adejobi said attempts to flout the directive would “attract severe sanctions on the leadership of the affected commands and formations”.

He added that all police officers must adhere to the ban, noting that “any police officer or POS operator found contravening this order, or conniving to conduct illicit financial transactions will face appropriate disciplinary”.

“Despite previous directives, it has come to the attention of the Force leadership that some Commands and Formations continue to flout this regulation,” he said.

“The IGP notes that the use of electronic payment devices within police facilities poses significant risks, including the potential compromise of sensitive information, financial irregularities, and the facilitation of illicit activities, therefore, strict adherence to this directive is non-negotiable.

“The IGP urges all officers and personnel to comply with this directive without exception, and warns that any police officer or POS operator found contravening this order, or conniving to conduct illicit financial transactions will face appropriate disciplinary and criminal action in accordance with the extant laws and regulations, and the Command/Formation leadership will equally be held responsible.”

News

Lagos state government shuts hotels, poultry over noise, air pollution

The Lagos State Environmental Protection Agency has shut down several businesses in the Ikorodu area of the state over environmental infractions.

The state Commissioner for the Environment and Water Resources, Tokunbo Wahab, disclosed this in a statement on X.com on Friday.

The statement read, “In a bold move to tackle noise, air pollution, and other environmental infractions, the Lagos State Environmental Protection Agency recently conducted a comprehensive enforcement operation in key areas of Lagos State, including Agric, Ibeshe, and Ikorodu.

“Despite prior warnings, several establishments, including hotels, bar, gas filling station, poultry farms, and lounge, continued to flout LASEPA’s directives.

“As a result, these establishments have been temporarily shut down to ensure compliance with environmental regulations.”

The affected businesses were said to include Victory Hotel, Wendy Bar, Moore Gas Plant, Provider Farm and Poultry, Cloud 24, Little Palace Hotel, City Groove Lounge and Bar, Destiny Castle, and B.S. Gold Warehouse.

In the statement, LASEPA stated that it has repeatedly warned businesses about the need to adhere to environmental standards.

The agency also vowed to intensify its enforcement efforts to ensure compliance with state environmental laws.

News

We have identified sponsors of planned nationwide protest, says DSS

The Department of State Services (DSS) says it has identified those behind the planned nationwide protest.

In a statement on Thursday, Peter Afunanya, DSS spokesperson, said the service is applying a “non-kinetic measure and conflict resolution” to address the impending protest.

There are reports that youths across the country are planning to embark on nationwide protest over the increasing cost of living.

The DSS spokesperson said the secret police found the planned demonstration to be “politically motivated”.

“While peaceful protest is a democratic right of citizens, the Service has confirmed a sinister plan by some elements to infiltrate the protest and use it to cause chaos and extreme violence in the land,” the statement reads.

“It has also identified the reason behind the protest to be political.

“The plotters desire to use the intended violent outcome to smear the federal and sub-national governments; make them unpopular and pit them against the masses. The long-term objective is to achieve regime change, especially at the centre.

“The Service has also identified, among others, the funding lines, sponsors, and collaborators of the plot.

“However, it does not think that aggression should be the first line of action in the instance, in handling the emerging scenario.

“It has instead variously applied non-kinetic and conflict resolution strategies, including moral suasion, stakeholder engagement, and other multi-track diplomatic shuttles, to dissuade the planners from actualising their undesirable objective.”

Afunanya said the “agitators” should use “ample ways” available to them to channel their grievances without resorting to violence.

“The Service calls on people of goodwill, leaders of thought, captains of industry, labour unions, student associations, youth leaders, the civil society, clergy, NGOs, women groups, civil servants, and politicians to shun any invitation to participate in any orchestrated violence, deliberately designed to cause disaffection in the country,” he said.

News

22 drug dealers convicted in July, says NDLEA

The Kano State Command of the National Drugs Law Enforcement Agency on Thursday disclosed that it secured the conviction of 22 drug dealers in the state in July 2024.

Confirming the convictions to newsmen, on Thursday, the Commander of the agency, Abubakar Idris-Ahmad, described the feat as a major victory in its fight against illicit drug trafficking and abuse.

Idris-Ahmad said, “Out of the 22 drug dealers convicted, one Abubakar Mu’azu’s arrest resulted in an altercation during which he stabbed an NDLEA officer.”

“Mu’azu was charged to court and sentenced to three years in a correctional centre, while the other convicts were sentenced to various terms of imprisonment.

“Different types of illicit substances were found in Mu’azu’s possession.”

The narcotics commander said that the command would continue the fight against drug trafficking and abuse and prosecute those culpable.

Idris-Ahmad commended the Chairman/ Chief Executive Officer of the agency, retired Brig.-Gen. Mohammed Buba-Marwa, for his unwavering support and commitment to the fight against drug abuse.

According to him, no amount of intimidation or violence would hinder the agency’s operatives from pursuing and bringing perpetrators to justice.

“Our operatives are trained professionals who will stop at nothing to ensure that those who engage in drug-related offences face the full wrath of the law,” he stated.

To accomplish its mission of ridding the state of drug addicts, the commander solicited the support of the general public, urging them to remain vigilant and report any suspicious activities related to drug abuse and trafficking to the agency for prompt action.

-

Health7 days ago

Health7 days agoWhat to eat and avoid when treating malaria

-

Politics1 week ago

Politics1 week agoSenator Monguno replaces Ndume as Senate Chief Whip

-

World1 week ago

World1 week agoComputer scientist claiming invention of Bitcoin faces criminal investigation in UK

-

Celebrities1 week ago

Celebrities1 week agoMohbad’s wife claims Joseph Aloba is her son’s greatest enemy

-

Politics1 week ago

Politics1 week agoAppeal court affirms Douye Diri as Bayelsa governor

-

Politics1 week ago

Politics1 week agoActress Hilda Dokubo suspended as Labour Party’s Rivers chairperson

-

Politics1 week ago

Politics1 week agoOndo LP Governorship candidate, Dr Ayodele Olorunfemi promises ₦120k minimum wage if elected

-

Entertainment1 week ago

Entertainment1 week agoRema’s ‘HEIS’ sets record for biggest opening week on Spotify Nigeria in 2024