Business

First Bank recovers N456 Billion loan from Heritage Bank before license revocation

According to reports, First Bank has received the full repayment of a “N456 billion loan” extended to Heritage Bank.

This recovery is part of a “bailout loan” arranged during the tenure of former Central Bank of Nigeria (CBN) Governor Godwin Emefiele.

According to top sources from First Bank, the CBN credited the tier-one bank prior to its decision to revoke Heritage Bank’s license, thus averting what could have been a significant impairment charge for First Bank.

On Monday, the CBN announced the revocation of Heritage Bank’s license, stating that “the bank has continued to suffer and has no reasonable prospects of recovery,” which led to the bank’s eventual collapse.

Details of the Payment

Verified information from newsmen indicates that the actual amount received by First Bank was N456 billion, concluding a seven-year wait since First Bank supported Heritage Bank in clearing.

First Bank’s financial statements reveal that the bank held balances with other banks amounting to N688 billion as of the first quarter ending March 2024, down from N735 billion in December 2023.

According to First Bank, these balances include clearing balances with other deposit money banks. First Bank provides clearing services for some banks in Nigeria, and the current balances within Nigeria include clearing exposures to banks as of December 31, 2023.

Push for Recovery: Efforts to recover the N456 billion loan intensified as Heritage Bank’s situation worsened over the years. However, a resolution was not reached until a new board and management took over the holding company of the bank earlier this year.

The amount was eventually credited to First Bank ahead of the official announcement of Heritage Bank’s license revocation, ending the seven-year wait.

This payment is expected to be reflected in FBN Holdings’ half-year financial statements, bolstering its cash positions and preventing the bank from incurring a write-off for the loans.

FBN Holdings reported a pre-tax profit of N358.8 billion in the first quarter of 2024, alongside an impairment provision of N227.4 billion.

Heritage Bank’s troubles began in 2019 when it faced severe distress and appeared on the verge of collapse. However, under Godwin Emefiele, the CBN pursued a policy of not allowing banks to fail, supporting Heritage Bank through various measures.

First Bank was given the green light by the CBN to backstop Heritage Bank’s clearing obligations.

Clearing in Nigerian banks refers to the process of settling financial transactions between banks, ensuring the correct transfer of funds from one account to another.

This process is vital for maintaining the banking system’s integrity and efficiency, involving several steps and mechanisms to facilitate the smooth exchange of financial instruments such as checks and electronic funds transfers.

Banks excluded from the clearing process are technically insolvent, indicating distress and preventing further exposure by other banks.

However, under Emefiele’s policy, the CBN supported Heritage Bank through First Bank, issuing a “Letter of Comfort” to the tier-one bank. This guarantee ensured that First Bank did not have to make significant provisions for the loan.

Auditors had often requested a provision for the loan, but this request was repeatedly dropped due to the CBN’s letter guaranteeing loan repayment.

This successful loan recovery is a significant financial maneuver for First Bank, reflecting strategic financial management and timely intervention by regulatory authorities to maintain stability within Nigeria’s banking sector.

According to information contained in the 2021 audited financial statement of the bank at a negative reserve of N230.8 billion as of December 2021. The bank had a share capital of just N53.9 billion and accumulated losses of N459.3 billion making it technically insolvent.

As of 2021, Heritage Bank reported it had a balance of N247 billon as balances due to banks in Nigeria. The bank also cited First Bank as the only bank owed the amount at the time. It is likely that the N456 billion paid to First Bank includes accumulated interests.

Heritage Bank is yet to make public its 2022 and 2023 financial statements.

Business

NNPC announces downtime on recruitment portal over unprecedented traffic

The Nigerian National Petroleum Company (NNPC) Limited has announced that its job application portal is currently experiencing downtime due to an ‘unprecedented’ surge in traffic.

On Friday, NNPC announced a recruitment exercise for qualified candidates, with the application period set to close on August 20.

Checks by Vanguard revealed that the agency’s website is displaying server error messages.

In response via X, NNPC stated that their technical team is actively working to resolve the issue.

“Due to unprecedented traffic to the NNPC Ltd. career page from applicants applying for vacancies, the site is currently experiencing slow load times,” the statement reads.

“Our technicians are working diligently to rectify the problem as quickly as possible. Please be assured that the application process deadline remains August 20, 2024.”

NNPC also reassured applicants of a transparent and merit-based recruitment process, urging capable Nigerians to take advantage of this unique opportunity.

Business

Zenith Bank seeks NGX approval to sell 5bn shares through rights issue

Zenith Bank Plc has sought approval from the Nigerian Exchange (NGX) Limited to sell 5.23 billion shares through rights issue to raise N188.37 billion.

According to a statement on Wednesday signed by Godstime Iwenekhai, head of the issuer regulation department at NGX, the qualification date for the rights issue is July 24.

NGX said Zenith Bank applied for the approval through Stanbic IBTC Stockbrokers Limited, the lender’s its stockbroker.

The capital market regulator said Zenith Bank plans to list a rights issue “of Five Billion, Two Hundred and Thirty-Two Million, Seven Hundred and Forty-Eight Thousand, Nine Hundred and Sixty-Four (5,232,748,964) ordinary shares of 50 Kobo each at N36.00 per share on the basis of one (1) new ordinary share for every six (6) existing ordinary shares held as at the close of business on Wednesday, 24 July 2024″.

On April 12, Zenith Bank announced plans to raise an undisclosed amount in the international and Nigerian capital markets.

According to the company, the funds shall be raised through the issuance of ordinary shares, or preference shares, whether by way of private placement, rights issue or both.

The company also said the board would propose increasing its issued share capital — from N15,698,246,893.50 to N31,396,493,787 — at the AGM.

Zenith Bank’s plan to raise capital comes after the Central Bank of Nigeria (CBN), on March 28, directed commercial, merchant and non-interest banks to increase their minimum capital requirements.

CBN adjusted the capital base for commercial banks with international licences to N500 billion, while national and regional financial institutions’ capital bases were pegged at N200 billion and N50 billion, respectively.

With a capital base of N270.75 billion, Zenith Bank needs N229.25 billion to reach the minimum capital requirement of N500 billion.

Business

‘600k households paid’ as FG resumes cash transfer scheme

Wale Edun, the minister of finance, says over 600,000 households have benefited from the direct cash transfer programme of the federal government following the resumption of payments.

Edun spoke on Thursday in Abuja during the half-year review ministerial press briefing, themed, ‘Economic Recovery and Growth: Progress and Prospects 2024’.

On July 18, 2023, President Bola Tinubu ordered an immediate review of the conditional cash transfer scheme — an intervention initiative coordinated by the national social investment programme agency (NSIPA).

The president later suspended all programmes administered by NSIPA for six weeks, as part of a probe of alleged malfeasance in the management of the agency and its programmes.

During a radio interview session in Kaduna, Mohammed Idris, the minister of information and national orientation, disclosed the federal government’s plan to resume the intervention schemes.

Speaking at the press briefing, the minister reiterated Tinubu’s commitment to the welfare of ordinary Nigerians and the government’s efforts to ensure transparency and accountability in its social protection initiatives.

“Following the resumption of payments, over 600,000 households have already received this direct transfer this week,” Edun was quoted as saying in a statement by in a statement on by Mohammed Manga, the ministry’s director of information and public relations.

Edun said the government has made significant strides in its economic reforms, “well on its way to achieving a step-change in the revenues of the government; closely in line with the budget for 2024”.

He also announced the government’s exit from the ways and means borrowing mechanism, highlighting successes of the government’s reforms while citing a projected budget deficit of 4 percent in the 2024 fiscal year.

Edun acknowledged the temporary hardships caused by the reforms but assured that Nigerians would soon benefit from the expected outcomes.

He said the government’s “well-coordinated economic policies are beginning to yield results, evidenced by the deceleration in inflation growth, a rise in foreign investments compared to the same period last year”.

The minister said one of the major priorities of the incumbent government in the immediate term is to reduce food prices and focus on providing all the necessary support to increase local food production, given the impact of high food prices on inflation.

He said efforts are underway to achieve this goal.

The minister said with the outcome of the first half of 2024, “the economy is turning the corner.”

Edun added that with macroeconomic stability, the economy is being well positioned for sustained and inclusive growth that creates jobs, lifts millions out of poverty, and drives domestic and foreign investments that would improve the general wellbeing of the average Nigerian.

-

Health7 days ago

Health7 days agoWhat to eat and avoid when treating malaria

-

Politics1 week ago

Politics1 week agoSenator Monguno replaces Ndume as Senate Chief Whip

-

World1 week ago

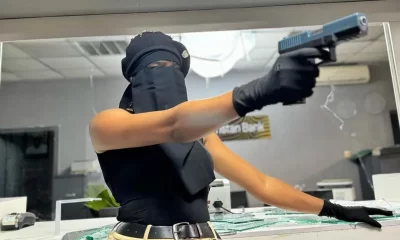

World1 week agoComputer scientist claiming invention of Bitcoin faces criminal investigation in UK

-

Celebrities1 week ago

Celebrities1 week agoMohbad’s wife claims Joseph Aloba is her son’s greatest enemy

-

Politics1 week ago

Politics1 week agoAppeal court affirms Douye Diri as Bayelsa governor

-

Politics1 week ago

Politics1 week agoActress Hilda Dokubo suspended as Labour Party’s Rivers chairperson

-

Politics1 week ago

Politics1 week agoOndo LP Governorship candidate, Dr Ayodele Olorunfemi promises ₦120k minimum wage if elected

-

Entertainment1 week ago

Entertainment1 week agoRema’s ‘HEIS’ sets record for biggest opening week on Spotify Nigeria in 2024