Business

CBN releases telephone numbers for reporting cash scarcity at ATMs

The Central Bank of Nigeria (CBN) has provided designated contacts for bank customers to report difficulties experienced with withdrawing cash over the counter or at automated teller machines (ATMs).

On November 29, Olayemi Cardoso, governor of CBN urged bank customers to report any withdrawal challenges via designated numbers.

Prior to the directive, the financial regulator had asked banks to prioritise cash disbursement through ATMs or face penalties.

But in a circular on Tuesday, jointly signed by Solaja Olayemi, its acting director of currency operations, and Isa-Olatinwo Aisha, its acting director of branch operations, CBN provided designated lines to help address customers’ challenges.

“Please refer to the various engagements and interventions from the Central Bank of Nigeria (CBN) on the above subject aimed at addressing efficient and optimal currency circulation in the economy,” CBN said.

“As part of these ongoing efforts, we would like to draw your attention to the following directives and Guidelines:

“Deposit Money Banks (DMBs): DMBs are directed to ensure efficient cash disbursement to customers Over-the-Counter (OTC) and through ATMs as the CBN will intensify its oversight roles to enforce this directive and ensure compliance.

“General Public Reporting: Members of the public who are unable to obtain cash Over-the-Counter or through ATMs at DMBs, are encouraged to report these instances using the designated reporting channels and format provided below.

“This will assist CBN in addressing issues hindering the availability of cash and further improve currency circulation.”

HOW TO MAKE A REPORT

To make a report of a bank branch or ATM not dispensing cash, the CBN said affected customers are to provide the relevant details which include, “account name/name of the DMB/amount /time and date of Incident(s) amongst others via the following dedicated channels”.

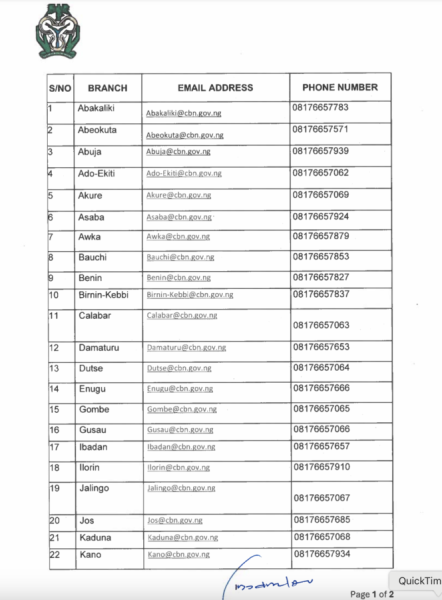

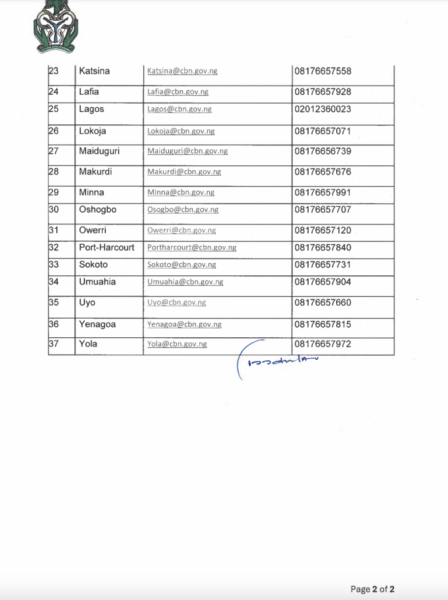

“Phone Call: Designated phone number(s) of the CBN branch in the state where the incident(s) occurred,” the apex bank said.

“Email: or send an email of the incident to the designated email address for the state in which the incident(s) occurred.”

Below is the list of designated numbers and emails for customers to use: