Business

Nigeria’s Export Earnings Rise By 10% To $14.4bn In Q1 2018

Nigeria’s total export earnings increased by 10.2 per cent to $14.394 billion in the first quarter (Q1) of 2018 compared with the $12.925 billion recorded in Q4 2017.

The Central Bank of Nigeria (CBN) disclosed this in its Q1 2018 ‘Brief on Balance of Payments Statistics,’ posted on its website.

The growth in the country’s export earnings in the review period also indicated an increase of about 44.4 per cent when compared to Q1 2017.

But earnings from crude oil and gas, which accounted for 93.3 per cent of total export earnings during the review period, increased by 10.1 per cent to $13,426 billion in Q1 2018, when compared with the preceding quarter.

On the other hand, earnings from non-oil and electricity exports also increased by 12.3 per cent to $967.08 million in the review period, when compared with the preceding quarter.

Also, available data showed that payments for import of goods (free on board) to the economy in the review period grew by 13.9 per cent to $8,642 billion above the level recorded in the preceding period.

This was attributed largely, to a 99.5 per cent increase in the imports of petroleum products.

According to the report, the provisional Balance of Payments (BOP) estimates for Nigeria in Q1 2018 showed a significant improvement in the country’s position as overall, it indicated a surplus of $7,322 billion, compared with a surplus of $6,180billion in the preceding quarter.

It also indicated an improved position, when compared to a surplus of $2.975 billion recorded in the corresponding period of 2017.

The current account balance (CAB) also improved significantly from a surplus of $3.656billion in Q4 2017, to a surplus of $4.469 billion in Q1 2018.

“The financial account balance indicated a net acquisition of financial assets of $10.293 billion in the review period as against US$3.859 billion recorded in the preceding period.

“The current account witnessed a positive outcome during the review period, recording a higher surplus of $4.469 billion as against a surplus of US$3.656 billion and $3.418 billion in the previous quarter and corresponding period of 2017, respectively.

“This development was largely attributable to the increased export earnings and the net surplus in current transfers,” it added.

Additionally, the report showed that the surplus in the country’s Goods Account increased to $5.752 billion in Q1 2018 from a surplus of $5.473 billion in the preceding quarter and $2.271 billion recorded in the corresponding period of 2017.

However, net out-payments for services during the review period decreased by 5.1 per cent to a deficit of $4.445 billion when compared with the level recorded in Q4 2017.

But when compared with the level in the corresponding period of 2017, it indicated a significant increase of about 201.2 per cent.

The country’s income account (net) also worsened to a debit of $3.272 billion in the review period, from $2.983 billion recorded in the preceding period.

This was significantly different from the $2.278 billion recorded in the corresponding period of last year.

“Current transfers (net) increased by 9.9 and 31.3 per cent to a surplus of $6.434billion in Q1 2018 when compared with the levels in the preceding quarter of 2017 and corresponding period of 2017, respectively.

“Provisional Q1 2018 estimates for the Financial Account showed an increase in net acquisition of financial assets from $3.859 billion recorded in Q4 2017 to $10.293 billion in the review period.

“It also indicated an improved position when compared to the net incurrence of financial liabilities recorded in the corresponding period of 2017.

“The stock of external reserves as at end March 2018 stood at $46.730 billion, indicating an accretion of 18.7 per cent when compared with the preceding quarter.

“When compared with the corresponding period of 2017, it recorded a higher accretion of 55.8 per cent. The reserves could finance approximately 16.2 months of imports, compared with 15.6 and 11.7 months of imports cover for the preceding quarter and corresponding period of 2017, respectively,” it added.

Business

JUST IN: CBN reduces banks’ LDR to 50%

The Central Bank of Nigeria has announced a review of the loan-to-deposit ratio (LDR) for banks, from 65 percent to 50 percent to align with the current monetary tightening.

LDR is used to assess a bank’s liquidity by comparing its total loans to its total deposits.

An increase in the loan-to-deposit ratio allows banks to expand their credits to businesses and individuals, however, a decline in LDR reduces their ability to loan customers from depositors’ funds.

The CBN disclosed the increase in a circular on Wednesday titled ‘Re: Regulatory Measures to Improve Lending to the Sector of the Nigerian Economy’, signed by Adetona Adedeji, its acting director of the banking supervision department.

“Following a shift in the Bank’s policy stance towards a more contractionary approach, it is imperative to review the loan-to-deposit ratio (LDR) policy to align with the current monetary tightening by the CBN,” the apex bank said.

“Accordingly, the CBN has decided to reduce the LDR by 15 percentage points to 50%, in a similar proportion to the increase in the CRR rate for banks.

“All DMBs are required to maintain this level and are further advised that average daily figures shall continue to be applied to assess compliance.

“While DMBs are encouraged to maintain strong risk management practices regarding their lending operations, the CBN shall continue to monitor compliance, review market developments, and make alterations in the LDR as it deems appropriate.”

Business

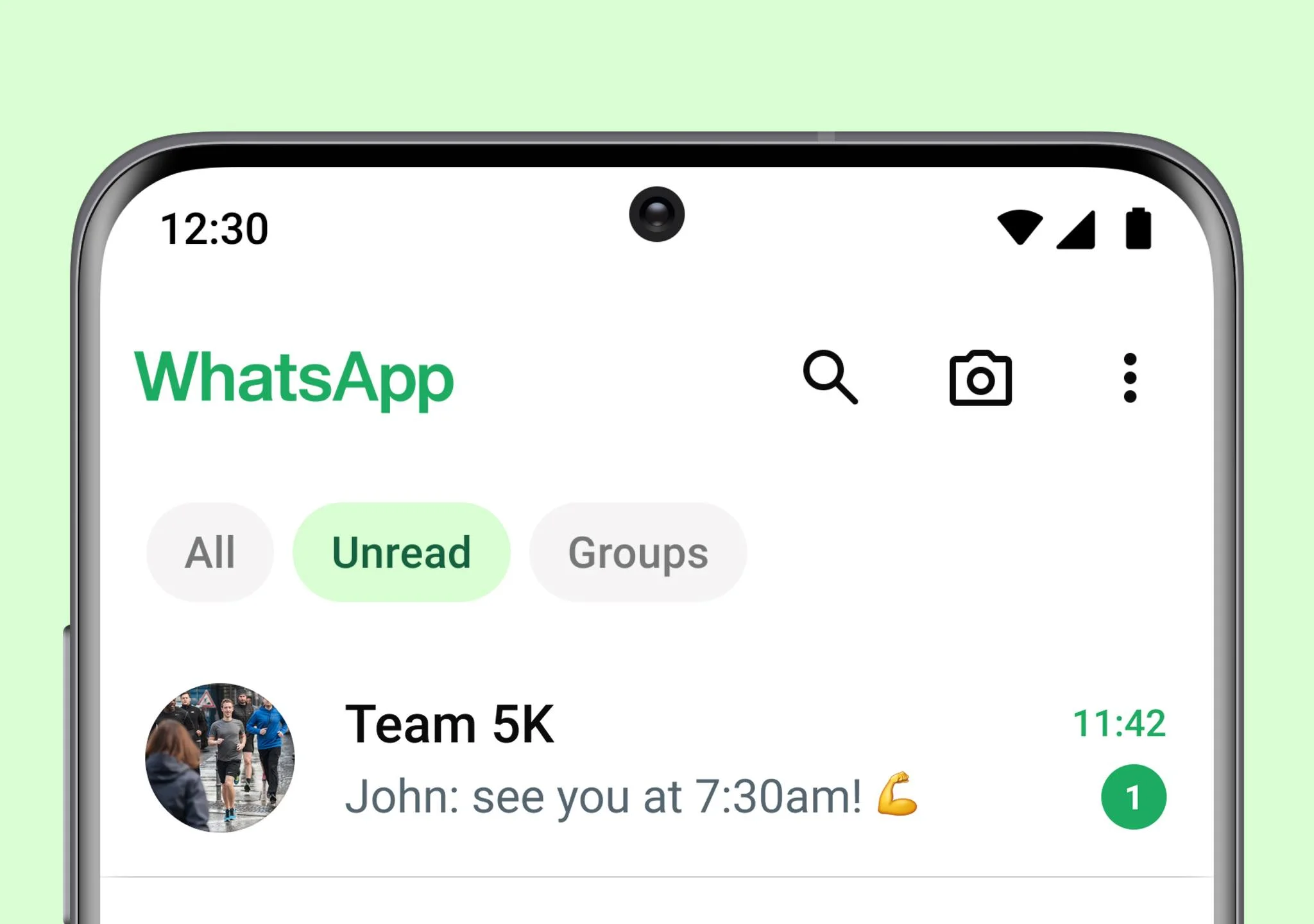

WhatsApp launches chat filters to allow users find messages faster

WhatsApp, the messaging app, has introduced chat filters to allow users to navigate through messages faster and more efficiently.

The Meta-owned platform announced the new feature in a blog post on Tuesday.

WhatsApp said it launched the new feature so that users can get to their important messages without having to scroll through their full inbox.

The social media service said the chat filters have three different features: “All, Unread, and Groups”.

It added that users can choose between any of the three filters that will appear at the top of their chat list.

“Opening WhatsApp and finding the right conversation should feel quick, seamless, and simple,” the post reads.

“As people increasingly do more on WhatsApp, it’s more important than ever before to be able to get to your messages fast.

“We believe filters will make it easier for people to stay organized and find their most important conversations and help navigate through messages more efficiently.

“We will continue to build more options to help you focus on what matters most.”

In recent times, WhatsApp has been actively rolling out new features to enhance user experiences and keep up with evolving communication trends.

In July last year, the Meta-owned firm unveiled an instant video messaging feature.

On August 8, the social network introduced a screen-sharing feature to enhance the video calling experience on its platform.

WhatsApp also introduced a feature that allows users to operate multiple accounts on a single device.

Business

NCAA suspends three private jet operators for engaging in commercial flights

The Nigerian Civil Aviation Authority (NCAA) says it has suspended the permit of three private jet operators for engaging in commercial flights.

Chris Najomo, acting director general of the NCAA, announced the suspension of the three private operators in a statement read to all airlines on Tuesday.

This is coming a day after Festus Keyamo, minister of aviation and aerospace, said the federal government would arrest and sanction illegal flights and non-certified personnel.

Najomo said the use of private jets for commercial purposes got Keyamo’s attention in November 2023, prompting the minister to issue directives for the cessation of such activities.

“Subsequently, in March 2024, the NCAA had issued a stern warning to holders of the permit for noncommercial flight (PNCF) against engaging the carriage of passengers, cargo or meal for hire reward,” Najomo said.

“The authority had also deployed its official to monitor activities of private jet terminals across airports in Nigeria. As a consequence of this heightened surveillance, no fewer than three private operators have been found to be in violation of the annexure provision of the PNCF and part 9114 of the NCAA regulations.

“In line with our zero tolerance for violation of regulations, the authority has suspended the PNCF of these operators.

“To further sanitise the general aviation sector, I have directed that a reevaluation of all orders of PNCF be carried out on or before the 19th of April 2024 to ascertain compliance with regulatory requirements.”

Najomo also said all PNCF holders will be required to submit relevant documents to the authority within the next 72 hours.

“This riot act is also directed at existing air operators certificate (AOC) holders who utilise aircraft listed on the PNCF for commercial chatter operations,” Najomo said.

“It must be emphasised that only aircraft listed in the operation specifications of the AOC are authorised to be used in the provision of such charter services.

“Any of those AOC holders who wish to use the aircraft for charter operations must apply to the NCAA to delist it from their PNCF and include it into the AOC operations specifications.”

The NCAA also urged travellers not to patronise any airline or charter operator who does not hold a valid AOC issued by the NCAA when they wish to procure chartered operation services.

Najomo also encouraged legitimate players in the aviation industry to report the activities of such “unscrupulous” elements to the authorities promptly for necessary action.

-

Entertainment1 week ago

Entertainment1 week agoBeyonce’s country album tops Billboard chart

-

Education6 days ago

Education6 days agoPrinting of JAMB slip: Beware of fake sites, police warn 2024 UTME candidates

-

News1 week ago

News1 week agoJnr Pope: NIWA rescues 7, recovers two corpses, 3 still missing in Anambra boat mishap

-

Business3 days ago

Business3 days agoX will start charging new users to post, says Elon Musk

-

Entertainment2 days ago

Entertainment2 days agoJUST IN: Cubana Chief Priest pleads not guilty to naira abuse charge

-

Entertainment7 days ago

Entertainment7 days agoAdanma Luke surrenders to police after boat mishap

-

Education1 week ago

Education1 week agoUNICAL sacks HOD over failure to present students for convocation

-

Business1 week ago

Business1 week agoNaira appreciates against dollar at official window, parallel market