Business

CBN warns banks on transactions related to Benin Republic

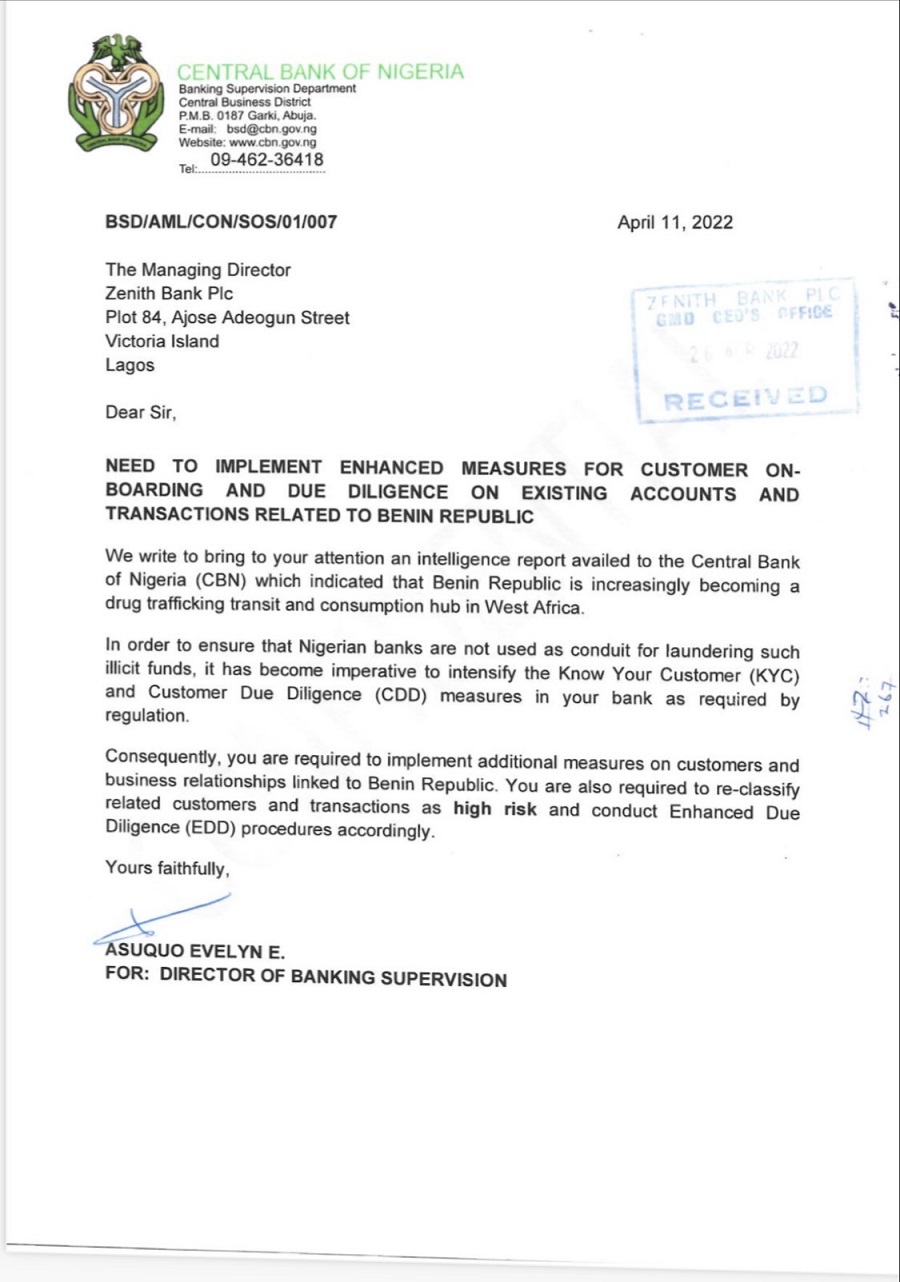

The Central Bank of Nigeria (CBN) has directed banks to implement enhanced measures on existing accounts and transactions related to the Benin Republic.

The apex bank said this in a circular dated April 11 and signed by Asuquo Evelyn, director of banking supervision department.

It said the directive was based on intelligence reports from competent sources that the Benin Republic is becoming a hub for illicit drug trade in West Africa.

To prevent Nigerian banks from being used as conduits for the movement of dirty money, CBN instructed the banks to strengthen their know-your-customer (KYC) and customer due diligence (CDD) policies.

“We write to bring to your attention an intelligence report availed to the Central Bank of Nigeria (CBN) which indicated that the Benin Republic is increasingly becoming a drug trafficking transit and consumption hub in West Africa,” the circular reads.

“In order to ensure that Nigerian banks are not used as conduits for laundering such illicit funds, it has become imperative to intensify the know-your-customer (KYC) and customer due diligence (CDD) measures in your bank as required by regulation.

“Consequently, you are required to implement additional measures on customers and business relationships linked to the Benin Republic. You are also required to re-classify related customers and transactions as high risk and conduct enhanced due diligence (ED) procedures accordingly.”

Speaking with newsmen today, Osita Nwanisobi, director of corporate communications, CBN, said the measures are aimed at strengthening Nigeria’s anti-money laundering and combating the financing of terrorism (AML/CFT) framework.

“Yes, the circular was issued by the banking supervision department of the CBN. This was based on intelligence reports from competent sources that the Benin Republic is becoming a hub for illicit drug trafficking,” Nwanisobi said.

“Hence, the advisory to banks to intensify their KYC/ CDD measures in order to ensure that our financial system is not used as a conduit for money laundering and terrorism financing. All of these are aimed at strengthening our AML/CFT.”

Business

Elon Musk threatens to suspend X accounts doing engagement farming

The owner of X, Elon Musk, has said he will suspend all accounts found to be doing engagement farming on the social media platform.

Several users on X are engaging in farming to boost their earnings from the content creator monetization program of the platform. This comes as the billionaire struggles to get rid of bots and fake accounts from X, formerly known as Twitter.

Engagement farming refers to when someone posts generic or obnoxious content to get likes or replies. The goal is to get people to interact with the tweet, which may lead to followers and more earnings.

- “Any accounts doing engagement farming will be suspended and traced to source,” Musk posted on Friday.

Aside from boosting their chances of getting paid by the platform, individuals and organizations use engagement farming to to artificially inflate their online presence and influence. This involved unethical practices and the use of fake accounts or tools to inflate metrics such as likes, retweets, and follower counts.

This activity disrupts the organic flow of information on X, and manipulated content lowers genuine voices. By blocking such accounts, X Crop aims to foster an original and organic online environment where content is rated based on its originality.

Business

Transcorp Hotels sells Calabar subsidiary to Eco Travels

Transcorp Hotels Plc says Eco Travels and Tours Limited, an indigenous hospitality company, has acquired its 100 percent stake in Transcorp Hotels Calabar Limited.

According to a statement on April 17 by Stanley Chikwendu, the company’s secretary, Eco Travels and Tours has a diverse portfolio including hotel management, wellness and fitness facilities, family-centric spaces, as well as interior and exterior design and decoration.

“Transcorp Hotels strategic focus is on Abuja and the significant continuing investment in the iconic Transcorp Hilton Hotel and in development opportunities in Lagos,” the company said.

In its published 2023 audited financial statements, Transcorp Hotels — a subsidiary of Transnational Corporation (Transcorp) Plc — recorded 36 percent revenue growth.

With the ongoing execution of its business strategies and optimisation of new business opportunities, Transcorp Hotels said it will continue to create more value for all its stakeholders.

Meanwhile, on January 15, Transnational Hotels joined the trillionaire club in the stock market after their valuation crossed N1 trillion.

As of Thursday, the company’s market capitalisation is valued at N1 trillion.

On March 4, Transnational Corporation announced the listing of its subsidiary, Transcorp Power Plc, on the Nigerian Exchange Limited (NGX).

Business

JUST IN: CBN reduces banks’ LDR to 50%

The Central Bank of Nigeria has announced a review of the loan-to-deposit ratio (LDR) for banks, from 65 percent to 50 percent to align with the current monetary tightening.

LDR is used to assess a bank’s liquidity by comparing its total loans to its total deposits.

An increase in the loan-to-deposit ratio allows banks to expand their credits to businesses and individuals, however, a decline in LDR reduces their ability to loan customers from depositors’ funds.

The CBN disclosed the increase in a circular on Wednesday titled ‘Re: Regulatory Measures to Improve Lending to the Sector of the Nigerian Economy’, signed by Adetona Adedeji, its acting director of the banking supervision department.

“Following a shift in the Bank’s policy stance towards a more contractionary approach, it is imperative to review the loan-to-deposit ratio (LDR) policy to align with the current monetary tightening by the CBN,” the apex bank said.

“Accordingly, the CBN has decided to reduce the LDR by 15 percentage points to 50%, in a similar proportion to the increase in the CRR rate for banks.

“All DMBs are required to maintain this level and are further advised that average daily figures shall continue to be applied to assess compliance.

“While DMBs are encouraged to maintain strong risk management practices regarding their lending operations, the CBN shall continue to monitor compliance, review market developments, and make alterations in the LDR as it deems appropriate.”

-

Education6 days ago

Education6 days agoPrinting of JAMB slip: Beware of fake sites, police warn 2024 UTME candidates

-

News1 week ago

News1 week agoJnr Pope: NIWA rescues 7, recovers two corpses, 3 still missing in Anambra boat mishap

-

Business3 days ago

Business3 days agoX will start charging new users to post, says Elon Musk

-

Entertainment2 days ago

Entertainment2 days agoJUST IN: Cubana Chief Priest pleads not guilty to naira abuse charge

-

Entertainment1 week ago

Entertainment1 week agoAdanma Luke surrenders to police after boat mishap

-

Entertainment1 week ago

Entertainment1 week agoHow Ghanaian Prophet predicted Actor Jnr Pope’s death in 2023 (Video)

-

Entertainment2 days ago

Entertainment2 days agoCubana Chief Priest arrives court for naira abuse trial

-

Health5 days ago

Health5 days agoFive benefits of drinking Okra water