Business

Naira redesign: CBN to collaborate with EFCC, ICPC to track huge withdrawals – Emefiele

The Central Bank of Nigeria (CBN) governor, Godwin Emefiele, says the apex bank will make it difficult for large cash withdrawals at banks as well as collaborate with law enforcement agencies like the Economic and Financial Crimes Commission (EFCC) and the Independent Corrupt Practices and Other Related Offences Commission (ICPC) to track such heavy withdrawals.

This was made known by Emefiele at a press briefing after the unveiling of the new Naira notes by President Muhammadu Buhari on Wednesday in Abuja.

Emefiele said the promotion of the cashless policy initiative was the reason for the reissue of these notes, noting that the CBN will insist on the implementation of the policy nationwide as the country moves towards a cashless economy.

To complicate huge cash withdrawals: Emefiele, at the briefing, said that the amount of money that can be withdrawn from the counter would be reduced drastically, adding that bulk withdrawals would require several procedures and security checks to track use.

He said, “There is no economy imbued with the thinking that it has to be a cash economy; the world has moved from predominantly cash to a cashless economy. And I think Nigeria and the Central Bank of Nigeria are prepared to move towards a cashless economy. And that is why following the redesign and issuance of this note, we will insist that cashless will be nationwide.

“We will restrict the volume of cash that people can withdraw over the counter.

If you need to draw large volumes of cash, you will fill out uncountable forms; we will take your data, whether it’s your BVN or NIN so that our law enforcement agencies like EFCC and ICPC can follow you and be sure that you are taking that money for a good purpose.”

Control of money supply: The CBN boss noted that among other reasons, the redesigned notes would ensure that the apex bank has ample control over the amount of money in circulation.

He also pointed out that the redesign of the naira is not targeted at anyone while noting that the past attempts to redesign the naira notes were resisted.

He added, “The Central Bank of Nigeria, by law, has the mandate to reissue and redesign currency for the country, and for Nigerian people, every five to eight years.

And I want to hope that after the event of today, the Central Bank of Nigeria can take it as part of its programmes to see that the currencies are designed or reissued every five to eight years.

“It is mainly because the central bank should be able to control the size of currency in circulation fully.

That is the actual mandate of the Central Bank of Nigeria because it has implications for monetary policy management in the country.

“There is no need for anybody to think this program is targeted at anyone.

Like you heard the president, he said, this discussion to redesign and reissue currency started early in the year.”

Business

JUST IN: CBN reduces banks’ LDR to 50%

The Central Bank of Nigeria has announced a review of the loan-to-deposit ratio (LDR) for banks, from 65 percent to 50 percent to align with the current monetary tightening.

LDR is used to assess a bank’s liquidity by comparing its total loans to its total deposits.

An increase in the loan-to-deposit ratio allows banks to expand their credits to businesses and individuals, however, a decline in LDR reduces their ability to loan customers from depositors’ funds.

The CBN disclosed the increase in a circular on Wednesday titled ‘Re: Regulatory Measures to Improve Lending to the Sector of the Nigerian Economy’, signed by Adetona Adedeji, its acting director of the banking supervision department.

“Following a shift in the Bank’s policy stance towards a more contractionary approach, it is imperative to review the loan-to-deposit ratio (LDR) policy to align with the current monetary tightening by the CBN,” the apex bank said.

“Accordingly, the CBN has decided to reduce the LDR by 15 percentage points to 50%, in a similar proportion to the increase in the CRR rate for banks.

“All DMBs are required to maintain this level and are further advised that average daily figures shall continue to be applied to assess compliance.

“While DMBs are encouraged to maintain strong risk management practices regarding their lending operations, the CBN shall continue to monitor compliance, review market developments, and make alterations in the LDR as it deems appropriate.”

Business

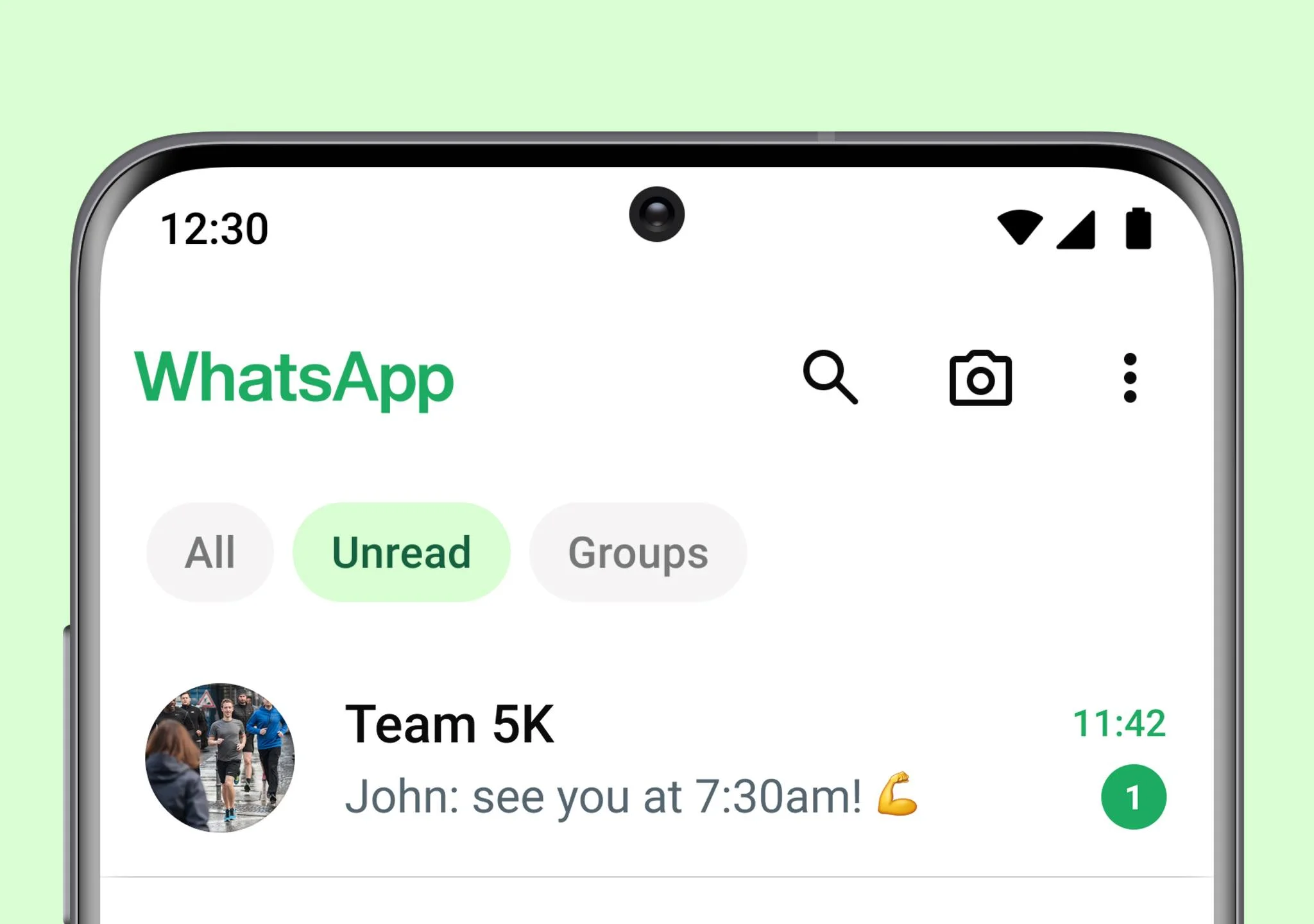

WhatsApp launches chat filters to allow users find messages faster

WhatsApp, the messaging app, has introduced chat filters to allow users to navigate through messages faster and more efficiently.

The Meta-owned platform announced the new feature in a blog post on Tuesday.

WhatsApp said it launched the new feature so that users can get to their important messages without having to scroll through their full inbox.

The social media service said the chat filters have three different features: “All, Unread, and Groups”.

It added that users can choose between any of the three filters that will appear at the top of their chat list.

“Opening WhatsApp and finding the right conversation should feel quick, seamless, and simple,” the post reads.

“As people increasingly do more on WhatsApp, it’s more important than ever before to be able to get to your messages fast.

“We believe filters will make it easier for people to stay organized and find their most important conversations and help navigate through messages more efficiently.

“We will continue to build more options to help you focus on what matters most.”

In recent times, WhatsApp has been actively rolling out new features to enhance user experiences and keep up with evolving communication trends.

In July last year, the Meta-owned firm unveiled an instant video messaging feature.

On August 8, the social network introduced a screen-sharing feature to enhance the video calling experience on its platform.

WhatsApp also introduced a feature that allows users to operate multiple accounts on a single device.

Business

NCAA suspends three private jet operators for engaging in commercial flights

The Nigerian Civil Aviation Authority (NCAA) says it has suspended the permit of three private jet operators for engaging in commercial flights.

Chris Najomo, acting director general of the NCAA, announced the suspension of the three private operators in a statement read to all airlines on Tuesday.

This is coming a day after Festus Keyamo, minister of aviation and aerospace, said the federal government would arrest and sanction illegal flights and non-certified personnel.

Najomo said the use of private jets for commercial purposes got Keyamo’s attention in November 2023, prompting the minister to issue directives for the cessation of such activities.

“Subsequently, in March 2024, the NCAA had issued a stern warning to holders of the permit for noncommercial flight (PNCF) against engaging the carriage of passengers, cargo or meal for hire reward,” Najomo said.

“The authority had also deployed its official to monitor activities of private jet terminals across airports in Nigeria. As a consequence of this heightened surveillance, no fewer than three private operators have been found to be in violation of the annexure provision of the PNCF and part 9114 of the NCAA regulations.

“In line with our zero tolerance for violation of regulations, the authority has suspended the PNCF of these operators.

“To further sanitise the general aviation sector, I have directed that a reevaluation of all orders of PNCF be carried out on or before the 19th of April 2024 to ascertain compliance with regulatory requirements.”

Najomo also said all PNCF holders will be required to submit relevant documents to the authority within the next 72 hours.

“This riot act is also directed at existing air operators certificate (AOC) holders who utilise aircraft listed on the PNCF for commercial chatter operations,” Najomo said.

“It must be emphasised that only aircraft listed in the operation specifications of the AOC are authorised to be used in the provision of such charter services.

“Any of those AOC holders who wish to use the aircraft for charter operations must apply to the NCAA to delist it from their PNCF and include it into the AOC operations specifications.”

The NCAA also urged travellers not to patronise any airline or charter operator who does not hold a valid AOC issued by the NCAA when they wish to procure chartered operation services.

Najomo also encouraged legitimate players in the aviation industry to report the activities of such “unscrupulous” elements to the authorities promptly for necessary action.

-

Entertainment1 week ago

Entertainment1 week agoBeyonce’s country album tops Billboard chart

-

Education4 days ago

Education4 days agoPrinting of JAMB slip: Beware of fake sites, police warn 2024 UTME candidates

-

News7 days ago

News7 days agoJnr Pope: NIWA rescues 7, recovers two corpses, 3 still missing in Anambra boat mishap

-

Entertainment18 hours ago

Entertainment18 hours agoJUST IN: Cubana Chief Priest pleads not guilty to naira abuse charge

-

Business2 days ago

Business2 days agoX will start charging new users to post, says Elon Musk

-

Entertainment6 days ago

Entertainment6 days agoAdanma Luke surrenders to police after boat mishap

-

Education1 week ago

Education1 week agoUNICAL sacks HOD over failure to present students for convocation

-

Business1 week ago

Business1 week agoNaira appreciates against dollar at official window, parallel market